♣ CLICK THIS TO STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

♥ CLICK THIS TO DOWNLOAD THIS FREE PDF SUMMARY HERE

♦ CLICK THESE FOR THE FOLLOWING Book | Summaries | Course

YouTube |Spotify | Instagram | Facebook | Newsletter | Website

The Money Mentor by Graeme Holm

- I help ordinary Mums and Dads burdened with standard 30-year home loans pay off those loans within 7 to 10 years.

- Paying your home loan off over 30 years is bullshit! It’s the biggest rip-off. When you’re sitting in your bank, arranging your home loan, their entire focus is on the minimum monthly repayment. That just means they’re forecasting their juicy profits over a 30-year period.

- Our aim is to disrupt the passive, inherited way of thinking encouraged by the banks and to completely change traditional Mum and Dad psychology.

- People can lie but numbers cannot.

- Many of us accept what our parents have taught us – money is hard to come by, we must work hard, struggle, scrimp and save. This is embedded in our subconscious mind creating a belief that acquiring wealth is difficult. Further, many of us are raised to believe wealth is acquired by many not deserving it or via unethical or selfish means. All these childhood beliefs are invalid. We accept this as correct, we expect to struggle, hence our mind creates our reality. This needs to change, because we all have the opportunity to succeed.

- Reduce debt to create wealth – then protect it.

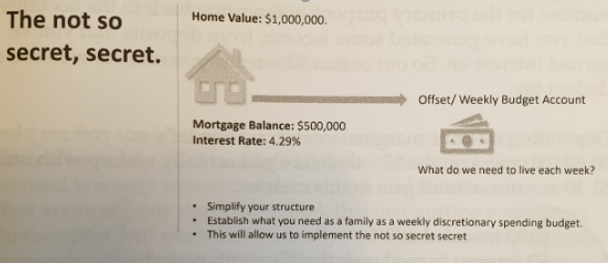

- All money goes directly into the loan account itself, then we schedule a weekly budget payment over to the offset account. This means the only amount of money sitting in Mum and Dad’s hot little hand with the tap of the debit card is a weekly budget of $750 a week (for example). That budget covers your discretionary spend, including: your petrol, your groceries, transport card, your coffee and lunch, takeaway meals, tickets to the movies, and anything of that nature.

- Everything else is in the home loan account and we simply pay all bills out of the home loan account. Money stays in the home loan account for as long as possible before being used to pay bills, reducing the interest payable on a daily basis.

- Reducing Interest Payments

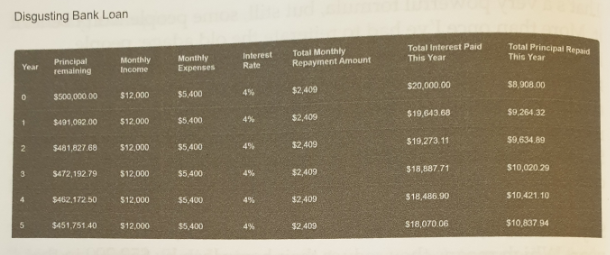

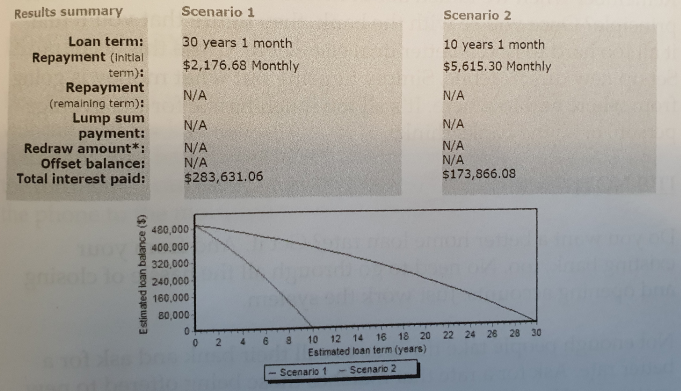

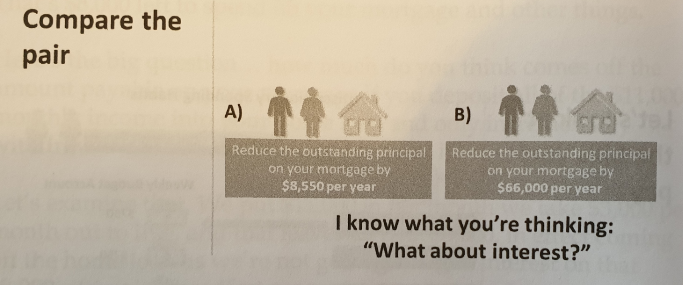

- What makes this so powerful is that most bank loans are only getting about $8,000 – $10,000 of the principle off the home loan each year over the first few years. The first 10 to 15 years of a home-loan serviced by minimum payments is all front-end loaded – essentially paying more in interest than in recycling the principal amount. On average, you’ll only reduce the original loan amount by about $50,000 – $100,000 in that period. Minimum payments means the debt reduction all comes off at the back end as the graph drops off towards the end of a standard 30-year mortgage.

- Our method attacks that front=end loading. When the potential interest payable is at its highest, we aim to actually pay as little interest as possible. That strategy is one of the key elements to our approach to saving money.

- Controlling Discretionary Spending

- The Great Australian default is that we all have a spreadsheet that tells us what our budget should look like and we know roughly what we spend on groceries, petrol, mortgage, and car loan, but the discretionary spending is just out of control.

- Spend what you need, pay off your debt and invest the rest to create wealth.

- Paying off any mortgage with only the minimum payments each month makes you the bank’s pawn. Making additional payments monthly to save interest, pays off your mortgage’s faster, leaving you with more money to invest. Taking this important first step creates a feeling of self-confidence toward financial independence.

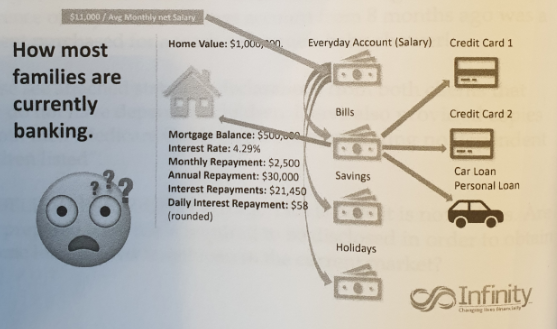

- The more bank accounts that you have open, the less money is in your mortgage and reducing daily interest charges. The more interest you pay, the bigger the banks profits. They’re in it to make money!

- All of those little accounts you have open are earning you 2%. Meanwhile, the exact same money could have been put on your mortgage and save you 5%. You’d be 3% better off in simple terms, though it’s actually even better than that.

- The plain fact is that we truly only need 2 accounts:

- 1) A fully transactional home loan account

- 2) Day-to-day bank account, which needs to be fully transactional online and 100% offsets your home loan.

- Industry Myths and Bullshit

- People were more likely to get divorced than change banks.

- Get a better plan, not a cheaper product!

- Banks will never randomly call you to offer you a better deal for no reason. You will have to force it or negotiate it yourself.

- Budgeting Basics

- A budget is a plan, prepared in advance, that, if adhered to, will leave you in a better place financially at the end than when you started. Budgeting properly gives every single incoming dollar a purpose. You’ll know exactly where it’s all going and, hopefully, more of it will be going on debt reduction than has been the case previously.

- Interest Earned vs Interest Saved

- You’ve got your home loan – you’re paying X% interest. You’ve got a coupe of (a few?) credit cards – you’re paying Y% and Z% interest. You’ve got some savings accounts – your earning M% interest. Card A gets paid from account 1. Card B from account 2 etc.

- If I draw lines between the cards and the accounts, look how quickly it gets very messy indeed. How do you ever keep track of all that and make sense of it? You probably don’t! Things get missed. Stuff doesn’t get paid properly. You need extra money one month, do debt increases instead of reducing.

- It’s better to have a single, fully transactional home-loan account which accepts direct deposits and direct salary credit in.

- Interest on your home loan is calculated daily and charged monthly. What does that mean in practical terms?

- $100 invested at 2%

- $2 interest earned over the 12-month period

- $102 is what you end up with, before tax

- $0.60 tax deducted

- $101.40 is what you actually end up with, after tax

- That’s simple, practical demonstration of interest earned.

- Interest Saved – Yeah baby (the good stuff)

- Interested saved, on the other hand, is a completely different beast, so let’s now examine the totally different effect of interest saved.

- Let’s say we take that same $100 and, instead of putting it into a bank account, we put that into our home loan. A home loan on which we’re being charged 4.29% interest.

- That would mean on our $100, we would earn $4.29 simply by not outing it into a bank account but instead, putting it into our home loan.

- Even better, not only do you save at a higher interest rate but, because it’s not taxed, you get to keep 100% of the saving.

- Ask yourself this simple question: would you prefer to have multiple savings accounts and give the government $0.60 out of every $2 that you earn in interest, for a net gain of $1.40, or would you rather save $4.29?

- $1.40 or $4.29…from the same $100?

- The answer to that is clearly a no-brainer.

- Based on that straightforward demonstration, you should see that you don’t actually need multiple bank accounts to get ahead. What you need is a fully transactional mortgage and what’s called an offset account.

- Discretionary Spending – The Not So Secret Secret

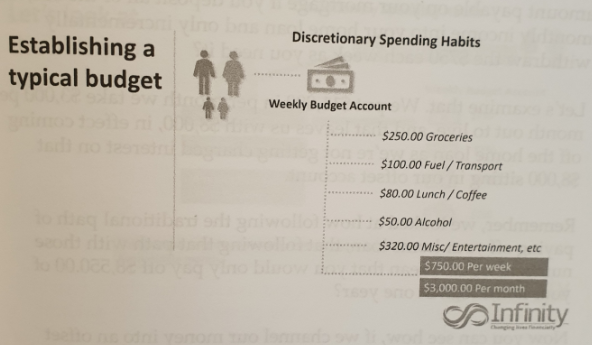

- Averaged out, the total spending on all of those things combined, amounts to around $750 per week.

- $250 groceries

- $100 transport

- $80 lunch & coffee

- $50 alcohol

- $320 other (entertainment, takeaway food, dining out etc.)

- Total = $750

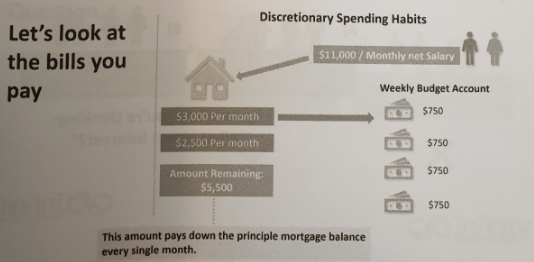

- The average family has somewhere between $1,800 – $2,200 of bills each month. That amount doesn’t include things like day-care or child-care costs, private education costs or what we call extracurricular activities that they do each month.

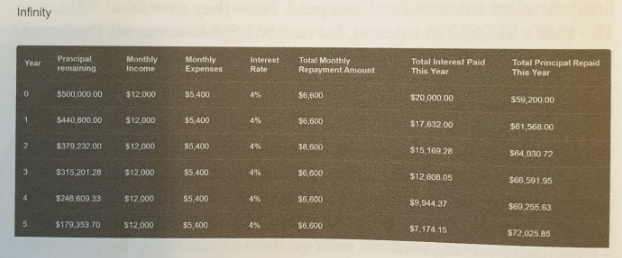

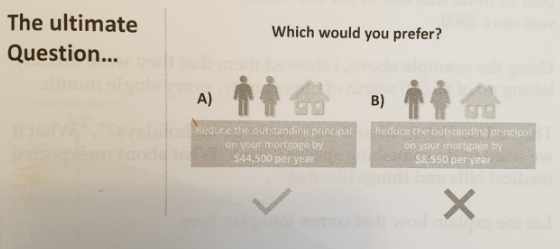

- Multiplying $5,500 by 12 months of the year, we are creating a scenario akin to not having to pay interest on $66,000 of your mortgage, effectively reducing the amount outstanding by $66,000, as opposed to the $8,550.00 that we were going to reduce following the process that most Australians adopt with their 25- or 30-year mortgage.

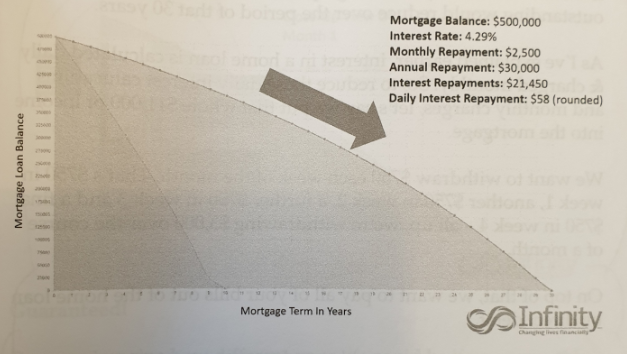

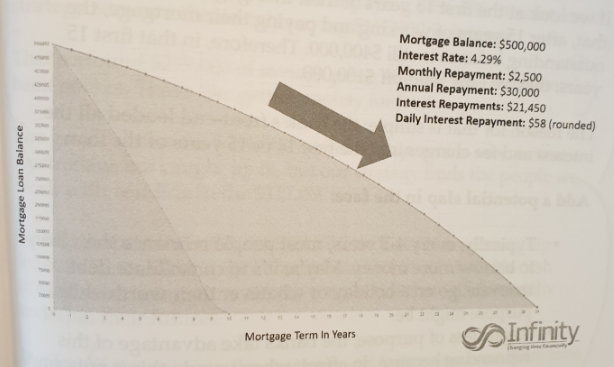

- A typical mortgage holder, using our example numbers, would be charged $21,450 in interest in any given year on the amount outstanding.

- Would you prefer to reduce the outstanding principal on your mortgage by $44,550 or $8,550 in a year?

- Your next question could be “Where on earth is that $44,500 going at the moment?”

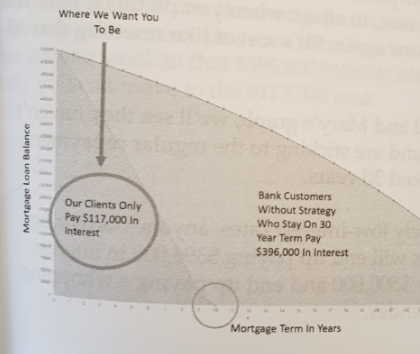

- If we look at this 30-year loan graph, showing how the amount outstanding would reduce over the period of that 30 years.

- As I’ve explained earlier, interest in a home loan is calculated daily & charged monthly. So, to reduce those daily interest calculations and monthly charges, let’s say we put that whole $11,000 of income into the mortgage.

- We want to withdraw $750 each week of the month. That’s $750 in week 1, another $750 in week 2, a further $750 in week 3 and a final $750 in week 4 – all up, we’re withdrawing $3,000 over the course of a month.

- On top of that, we want to pay all of your bills out of the home loan by direct debit.

- Repeat that $750 process over and over again, week by week and month by month, with interest being charged daily. Now, recall we talked about taking $10 or $20 a day off that $58 a day interest we’re paying. Can you see by this graph where that $10 – $20 a day saving is going to come from?

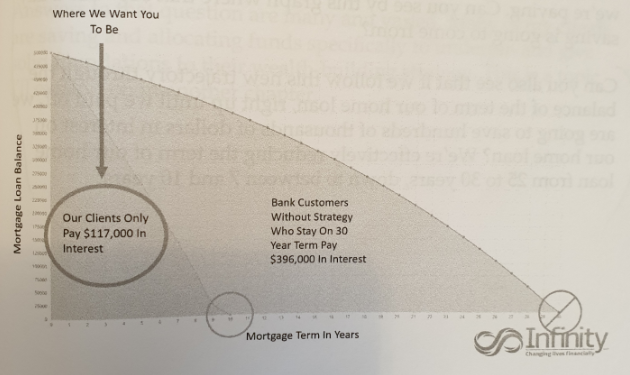

- Can you also see that if we follow this new trajectory through the balance of the term of our home loan, right up until we paid off, we are going to save hundreds of thousands of dollars in interest on our home loan? We’re effectively reducing the term of our home loan from 25 to 30 years, down to between 7 and 10 years.

- Can you imagine how different your life could be if you were able to wipe out your mortgage in 7 to 10 years? What would you do with the extra money available to you?

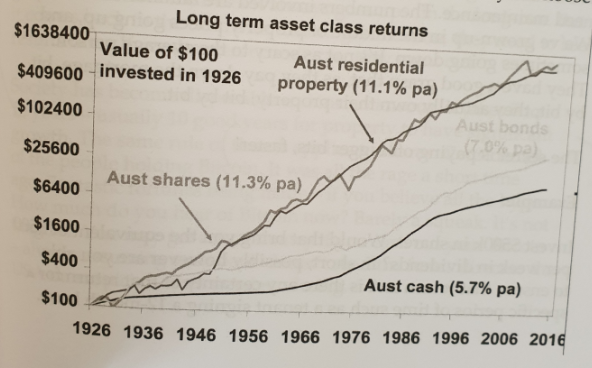

- Shares vs Property

- The last 100 years, the 2 lines are practically even.

- Most average people are comfortable with bricks and mortar.

- Shares just seem too volatile, too unpredictable for the average person. A new President gets elected in America and shares plummet – what happens if you need to cash in that day?

- Not many lay people get wealthy through shares, other than by accident. Marking money from shares usually takes knowledge and experience, both of which often come by getting your fingers burned once or twice…and your average punter is risk averse.

- You want to retire at 67? Well, the share market will be wherever it is – could be going gangbusters, could be in a slump. You roll the dice and take your chances.

- Property, on the other hand, practically everyone is comfortable with. We’ve all lived in a property for our whole lives. We understand paying rent or dragging a mortgage behind us. We understand associated expenses. We understand buildings needs maintenance. The numbers involved are familiar to us. We’ve grown-up in the middle of property prices going up, and sometimes going down. It’s not scary to the average person. They have a good grasp that, as they pay down the mortgage, bit by bit, they actually own their property, bit by bit. The secret is paying off bigger bits, faster!

- The wealthiest people in Australia all have significant property portfolios that have been held for a significant period of time.

- Shares, property or any other form of investment must be held with a long term view as the magical mystical word that all investors need to be aware of is ‘TIME’.

- Investing in Property

- Buying an investment in Sydney or Melbourne Metro areas isn’t necessarily the best way to start your portfolio. It has a very high entry price and very low rental return. Why buy a $1,000,000 2-bedroom apartment in Sydney Metro Fringe with it’s equally high strata fees when you an buy 2 x sub $500,000 houses in other markets that will most likely rent for $450-$500 per week. Compare the pair: $1,000,000 of debt at 4.5% is going to cost you $45,000 each year in interest. That’s approximately $865 per week in interest only! If you’re renting a property like that, it would cost between $500-$700 per week. However, as in investor, it is costing you $865 less the rent of $500-$700 per week.

- Example:

- Sydney Metro $1,000,000 purchase price with annual rent of $26,000-$36,400 (a 2.6% – 3.64% per annum return) with annual interest expense of $45,000 at 4.5% per annum.

- 2 x 4 bedroom houses at $500,000 each renting at $450 per week minimum – $1,000,000 purchase price with annual rent $46,800 (a 4.68% per annum return) with annual interest expense of $45,000 at 4.5% per annum.

- Buy property for sure. But rent it out. Earn income from it. Earn capital growth from it. Use its growth to buy more property…and keep the cycle going.

- Meanwhile, rent where you want to live. You’ll pay less to rent a good property in a better area than you could afford to buy in. You’ll never have to worry about maintenance or selling the place at a later date.

- All the while you’re renting in your favorite suburb, your investment properties are – with a bit of strategy, planning and luck – growing in value and bringing you a steady stream of income.

- Mortgage Insurance

- LMI – Lender’s Mortgage Insurance. It does what it says it does – protects the lender, not you. The lender is protecting their investment of money and because you had less than 20% deposit, they consider you a higher risk.

- Will the rent and tax benefits cover the loan repayments? Better still, will the income and deductions cover the loan repayment and a small surplus of cash-flow be left to reduce debt somewhat?

- Research tells us that financial problems are the main cause of martial and relationship breakdown. Often, the reason is due to the partners not understanding what their financial responsibilities are, the way to obtain a better financial outcome, what actions to take and what to avoid, and again how, to do it.

- We encourage property investors to invest in a range of markets so they are covered if anything happens to any one single market. Risk mitigation 101.

- Understanding where your money goes is part of that process. Will you still want to spend cash on that pack of smokes, or on the Red Bull at the petrol station once you know that interest on your home loan is calculated daily? Money left in your home loan account is money saved on a reduced interest payment. It’s that simple.

- Make your own lunch. That’s money saved. Easily. And you can see it at the end of each month in your miraculously lower interest payments. Not only are your interest payments going down, but you’re actually owning more of your home – brick by brick, month by month. In a nice little repetitive cycle, the more you own, the less you owe, meaning ever-decreasing, interest payments and more coming off the mortgage. Until, suddenly, quicker than you thought possible – no mortgage. No debt. No interest pyaments. Your home is a wholly-owned asset. An asset which can be used to buy another property and generate an income stream to build wealth.

- Ask yourself if you have the commitment to forego a little – not all – of the instant fix in order to invest in yourself and that delayed gratification. All it takes is a series of small, incremental changes to your current lifestyle that you can get comfortable with and build on, bit by bit.

- Financial Security

- What does financial security look like to the average Australian? To anyone reading this book, whether you decide the information in here is for you or not, you would probably argue that a roof over our head with no mortgage or rental payments due would fit the description of ‘financial security’. When all that’s left to pay for is the standard utilities and your food, it’s fair to say you’re secure financially.

- Please take control of the family discretionary spending budget today and start reducing debt. It is surely the simplest and easiest risk-free way of creating wealth. Just smash down that home loan.

- Modern Bank Account

- Our modern home loan account is bank account – your bank account. It does everything! It must be set up so that we have direct salary and/or other credits going direct to the home loan. Salary and other credits are thereby instantly reducing the amount of money borrowed, even if it’s only temporarily, and reducing the amount owed means a reduced amount of interest to be paid.

- We build in a free, unlimited redraw facility and set up direct debits for all your regular home bills – e.g. utilities, interest, Foxtel, etc.

- Home loan interest is calculated daily and charged monthly. Therefore, the more times we reduce the actual balance, and the longer we leave funds in the home loan, the better the outcome is for us.

- If we are sitting our funds in a savings account (particularly if this account is not offset), we are not making any inroads into the daily interest costs on our home loan, even if, for example, we are making payments fortnightly.

- Remember, this is a “Fully Transactional” home loan with the bells and whistles.

- We all trade time for money in our jobs, however, it is what we do with that net income that we trade our time for, week in, week out that counts, we need to wisely invest that money to create passive income to fund our desires lifestyle in years to come.

- Traditional Mortgage Graph – Recap

- The first thing that you need to understand when you are seeking to pay debt off fast is to learn about how the banks or your lenders make their money. Let’s work through a straightforward, real-life example to demonstrate how a mortgage is structed to the bank’s advantage…and what you should do to turn that around to be structured to your advantage.

- Fred and Mary have taken out a $500,000 mortgage on a typical 30-year term.

- If we look at the first 15 years of their mortgage, we can see that, after 15 years of working and paying their mortgage, the outstanding balance is still $400,000. Therefore, in that first 15 years, they’ve only paid off $100,000.

- The reasons for that is simple: the bank’s front-end loaded all the interest and fee charges into the first 14 or 15 years of the loan.

- Add a potential slap in the face:

- Typically, every 4-5 years, most people refinance their loan to borrow more money. Maybe it’s to consolidate debt, renovate, go on a holiday or whatever their worthwhile purpose might be.

- Regardless of purpose, the banks take advantage of this refinancing because, in effect, when you do this it puts you back at square one again. It’s sort of like resetting that 30-year term.

- Using current, relatively low-interest rates, anyone borrowing $500,000 over 30 years will end up paying $396,000 in interest. Meaning they borrow $500,000 and end up paying a whopping $896,000 back to the lender.

- When you hear about some of the big banks posting their billion-dollar profits, this is how they are doing it. This is how they are making their money…from people just like you!

- Of course, no lender will lend you money for free. However, in this case, you can see that instead of paying $396,000 interest, our strategy sees our clients only paying $117,000 in interest.

- That’s around $279,000 of savings going straight into our clients’ back pocket. That’s like getting money for free!

- If you can pay the mortgage off faster, you have more time to leverage the money you earn to end up in a better place.

- Reach out to Graeme Holm at help@moneymentor.com.au

♣ CLICK THIS TO STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

♥ CLICK THIS TO DOWNLOAD THIS FREE PDF SUMMARY HERE

♦ CLICK THESE FOR THE FOLLOWING Book | Summaries | Course

YouTube |Spotify | Instagram | Facebook | Newsletter | Website