< DOWNLOAD THIS SUMMARY IN PDF HERE >

< FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website

The Next Millionaire Next Door: Enduring Strategies for Building Wealth by Sarah Stanley Fallaw and Thomas J. Stanley

You may not be familiar with Dr. Sarah Stanley Fallaw, but you’ve probably heard of her dad, Dr. Thomas J. Stanley.

He was the author of one of most widely read financial books into the world, the Millionaire Next Door, which was the bestselling personal finance book back 25 years ago.

Sarah also knows a thing or two about the average millionaire as she’s surveyed over 4,000 of them.

She’s the president of DataPoints which helps advisers understand their client’s money mindset and published a follow-up to her father’s book titled, The Next Millionaire Next Door.

She read her dad’s book while attending college, but had no idea the importance of his work and what was going to happen with the book.

Who would have thought surveying a bunch of everyday people that turned into millionaires would become so popular?

At that time, very few books had accomplished the kind of research on the affluent that Stanley performed.

Not just the seemingly affluent, but those households who actually had a high net worth of $1 million or more.

Some of the characteristics he found from these “everyday millionaires” included:

- They live well below their means.

- Financial independence is more important than displaying high social status.

- Most owned their own business.

- They spent less thanthey earned.

This is the exact OPPOSITE of how most doctors and other high-income earners live. Their main focus is trying to “keep up with the Joneses” with luxury houses and expensive cars leaving them with little to no savings.

They’re used to spending everything they earn and sometimes more.

The worse part of falling into this trap is that it’s a hard one to get out of.

Despite the evidence-based financial planning principles taught throughout The Millionaire Next Door, many people continue to ask, “Why am I not wealthy?”

Although it’s been over 25 years since the book was originally published, have things changed that much? Are the principles for wealth accumulation that much different now?

Unfortunately, in 2015, Dr. Stanley was killed by a drunk driver before completing research for a follow up book.

The good news is that Thomas Stanley’s daughter, Sarah, continued to carry on his work to bring their findings together in their book, The Next Millionaire Next Door.

Most of the book’s data was from a survey conducted of affluent Americans between 2015 and 2016.

Let’s take a look at what they found…

The Next Millionaire Next Door “The Sequel”

After the original book The Millionaire Next Door was published, there was some that stated the reason why these “everyday folk” turned into millionaires was due to the booming economy along with a host of other excuses.

One of the main reasons that Fallaw and her late father decided on a sequel was to see if there were lifestyle and behaviour changes noted in today’s millionaire households.

Here’s a few of their findings of what Today’s Millionaire looks like….

A Portrait of Today’s American Millionaires

- Most were married men in their 60’s that believed a spouse was critical in economic success

- Median annual income = $250,000

- Median net worth = $3.5 million

- Most didn’t become wealthy until their late 40s or early 50s

- Less than 1/3 rely heavily on a financial planner

- 70% say they know MORE about investing than most financial advisors

- More than 60% have 30% or more invested in retirement accounts

- Over 33% invest in real estate

- More than 70% know their personal expenses, 59% are frugal

- Most spent on jeans = $50, on sunglasses = $150, on a watch = $300

- Tend to drive Toyotas, Hondas or Fords at least 3 years old

- Median price paid for a car was $35,000

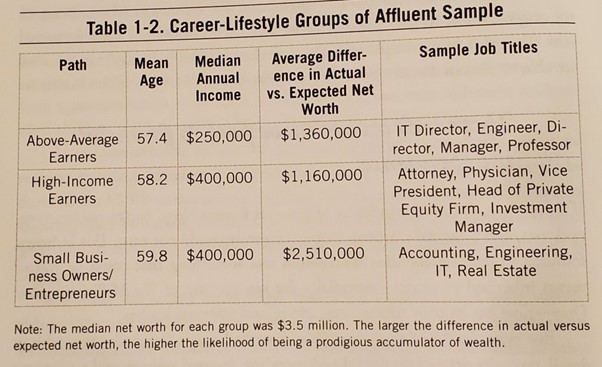

Paths To Wealth

No matter what path the person took to reach millionaire status, roughly 70% stated they’ve always been frugal.

The majority of those reading this article fall into the high-income earner group. These individuals are often tempted to look “the part” of their colleagues by purchasing the “doctor” house, luxury automobiles and other expensive consumer goods. To them, status symbols rule their life.

To build wealth with a high income takes considerable discipline in the consumption arena. This is becoming increasingly harder as more than 70% of Americans are on social media and can be easily influenced by what others are doing or buying.

To have economically self-sufficient children, this group must apply and teach frugality.

Moonlighters, Gig Workers, and the FIRE Community

One of the main differences between both books has to do with the rise of those that obtain side gigs in order to reach FIRE (Financial Independence Retire Early). It’s now much easier to have multiple sources of income than it was a decade ago.

With technological resources at your fingertips, anyone can create multiple businesses in a matter of minutes.

The Discipline of Wealth Building

The #1 success factor noted that determined wealth was…discipline.

In 2016, 91% of millionaires rated being disciplined as the most important success factor.

Specifically, discipline is required to take income and transform it into wealth (remember that income does NOT equal wealth).

This discipline includes knowing:

- how much you bring in

- how much you spend

- creating a budget to ensure the difference is in the positive camp

More than 9 out of 10 of the top 5% high-income people in America reported that being well disciplined was very important in explaining their socioeconomic success. This finding is consistent over time.

From The Millionaire Mind, we’re reminded that “a disciplined person sets his sights on a lofty target, then figures out productive ways to reach it. Disciplined people aren’t easily sidetracked.”

Discipline often requires going against the tide, including the tide of your social influences, and perhaps even how you were raised or long-held beliefs about what you’re entitled to today.

“One man pretends to be rich, yet has nothing, another pretends to be poor, yet has great wealth.” – Proverbs 13:7

America: Where Millionaires Are Still Self-Made

One of the most surprising aspects of The Millionaire Next Door was the finding that 80% of millionaires were self-made.

The same trend rang true after surveying the affluent for The Next Millionaire Next Door.

In Fallaw’s decades of surveying and studying millionaires, she has consistently found that 80-86% are self-made. That also applied to decamillionaires.

Even though economic opportunities continue to be huge in the U.S., most Americans don’t have much wealth. The main reason is they spend all or most of their income on liabilities or things that have little to no lasting value.

They lack the discipline (there’s that word again) required to accumulate wealth. Many American households are on a treadmill of working and consuming.

Do The Opposite

Our income, while statistically related to wealth, is NOT wealth. When we start to understand this (especially the high-income earner), we start seeing the criticality of our savings rate.

This rate is driven NOT by what we make but instead by what we do (how we consume and save).

It’s up to us to save more than we spend and live below our means. This is a mathematical truth in building wealth and financial success.

Once we understand that a lifestyle of consumption, one that’s more interested in appearing wealthy, is driving most Americans into a lifetime of dependency, work, and little economic freedom, we can begin to create an alternative plan for our lives.

It may look very different than our parents or grandparents, and unless you’re lucky, it’ll look very different than those around you or on your social media feed.

Influences on Wealth

As science has shown in almost all aspects of our lives, why we do what we do is a combination of our unique characteristics and how we were raised.

Growing up, we can’t choose where we come from, who our parents are, or what kind of early education we receive.

But as adults living in a society that doesn’t dictate our choices, we have the freedom to choose with whom and how we spend our time. These choices can influence our financial health and future.

Those who are financially independent focus on their own choices, taking responsibility for their money-related actions and behaviors.

Recent research shows that few other factors help shape how we save and spend money like our upbringing and our family’s influence. Adult children who reported that their parents were frugal, discussed money-related matters, and demonstrated good money management skills were more likely to be prodigious accumulators of wealth compared to those who did not experience this same type of upbringing.

A vast majority of young people learn about a family’s propensity for saving and financial management through direct observation versus through conversations regarding these behaviors.

In other words, parent behaviors tend to stick with children more so than discussions of what ought to be done related to money. So, if you’re a parent then remember that your kids are watching you!

And action speaks LOUDER than words.

The Trouble with the Status of Doctors

Physicians and surgeons earn more than 4x as much as the average American each year ($210,170 compared to $49,630).

There are approximately 650,000 physicians and surgeons in the United States and they’ve typically fallen into a stereotype of high-income earners who are challenged in building wealth.

In Fallaw’s research at her company DataPoints, the majority of physicians fall into the 33rd percentile or below on the assessment regarding frugality and financial acumen (measure of knowledge and expertise in investing and financial management).

Often, physicians’ median net worth is negative, due in most part to their student loans and age, but there’s something else at play: the adherence to the stereotype of doctor status.

In society, they’re expected to play their part.

Strengths for Building Wealth

The Next Millionaire Next Door created a helpful list to ensure households built wealth called:

Critical Tasks for Household Financial Management

General

- Consider the outcomes of potential actions before deciding on a course of action

- Make financial decisions based on household’s budget, plans, and long-term goals

- Focus financial management efforts on becoming debt-free

Spending

- Live (spend) below means (income/net worth)

- Spend less on expenses than household’s total income in a given time period

Budgeting

- Create an emergency fund

- Budget enough money for basic needs (i.e., food) before budgeting for optional purchases (i.e., entertainment)

- Account for important household needs (i.e., food, clothing, shelter) in preparing budget

- Analyze budget and financial goals when considering a significant life change (job changes, additional children, moving locations) that may impact goals

Administrative Tasks

- Pay bills on time to ensure no late fees or interest charges apply

- Complete and file tax returns on time (whether in-house or with assistance)

- Pay credit card bills on time to ensure no interest charges are incurred

- Pay entire balance of credit card each month

Working with Others

- Discuss unplanned or unexpected purchases with spouse/significant other prior to purchase

- Work with spouse/significant other as a team when managing household financial issues

Investing

- Understand the nature of investments and their risk and return profile

- Invest in employer-provided retirement accounts

- Understand the appropriate level of risk to take for own investment portfolio

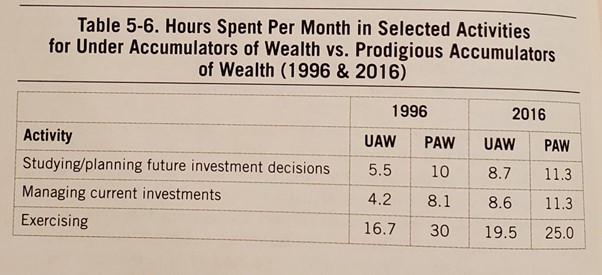

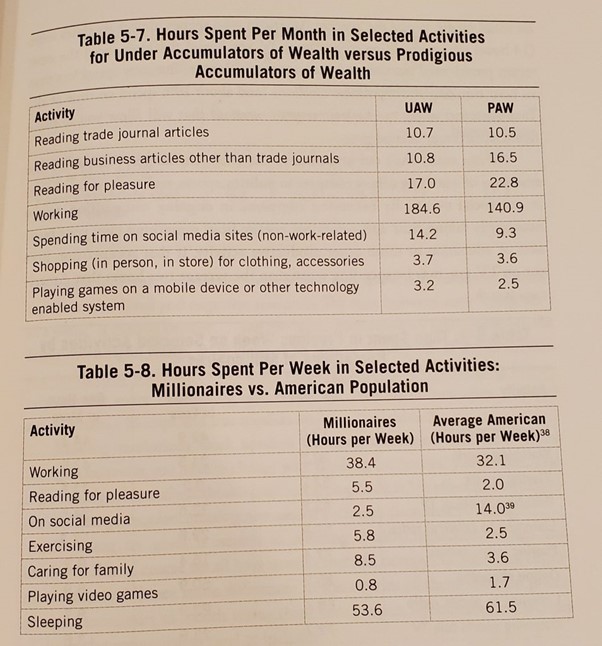

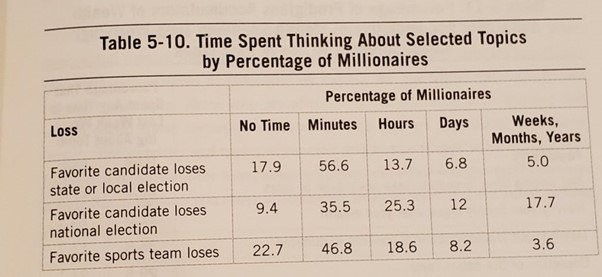

Occupying Our Minds and Time

How we spend our time can either support our financial goals or detract from them.

- What activities occupy the time of millionaires?

- How do these activities compare for prodigious accumulators (PAWs) and under accumulators of wealth (UAWs)?

Paws, those who are adept at transforming their income into wealth, spend considerably MORE time reading business articles and reading in general than their under accumulating peers, but perhaps it’s because our under accumulating friends are working more than the PAWs.

In Fallaw’s research, they noted that UAWs are spending MORE time on social media sites (14 hrs) as compared to PAWS (9hrs) per week.

Consider any number of technological distractions today: From social media to texting to gaming, how many hours a day do YOU spend on your devices?

Distractions are a significant reason why many struggle to reach FI or achieve other goals. We know that the more we’re able to focus without distractions, the better we’re able to build true wealth long term.

How much time do today’s millionaires spend on the so-called “excitement” of the day? Most reported only spending 2.5 hours per week on social media vs the average American who spends almost 6x more (14 hours per week).

What about thinking about presidential outcomes? Most spend less than an hour thinking about political elections (and about 10% spend no time at all).

Millionaires…in a “Regular” Job?

Similar to 1996 when The Millionaire Next Door was published, today it’s possible with an average to higher-than-average income, to become a millionaire through steady, prudent, disciplined financial management and regular income- regular meaning not extraordinary commissions from sales jobs or extremely high salaries like those of doctors, attorneys, and CEOs.

This is GOOD news for the high-income earner!

For most Americans, one’s desire, discipline, and intellect are more important factors in accumulating wealth than earning a high income.

The problem today among many high-income earners is that they think that money (income) is the MOST easily renewable resource.

What are 20 of the key findings of this book?

- The same trends exist as before (in 1996 when the first book was released). In other words, spending habits are a bigger indicator of wealth, as are behaviours more generally, rather than income.

- They found that even in poor societies, the same behaviours that are key to wealth, such as focus and discipline, are key.

- They deal with the survivorship bias issue. One of the critiques of the original book was that only the “cream of the crop” were selected. In other words, it might be true that many of the world’s millionaires are teachers, accountants and other mid-income professionals, but surely they are just the few that have succeeded.

- Most millionaires don’t look or act rich.

- One reason why many high-income executives aren’t always wealthy, is peer pressure. In other words, if all your banking or legal colleagues are boasting about going to a luxury holiday over the weekend, you are more likely to be like them. In comparison, if you are a teacher, you are less likely to feel the same pressure. That doesn’t mean that there aren’t many wealthy, high-income people. It more explains why this isn’t as prevalent as it should be.

- As a follow up to point 5, however, social media has started to change the dynamics. These days, even mid-income people are likely to feel pressure to “keep up with the Jones” due to Facebook and other social media

- Only some people use income to create wealth. Wealth is certainly not an autonomic ticket to wealth as countless sports and entertainment celebrities, and lottery winners, found out judging by the bankruptcy statistics.

- Many of the millionaire next door types had good habits early on. For example, one of the millionaire next door’s that is featured in the book, was taught by his frugal grandparents and parents to save 10% of what he makes. So even at college, he saved 70 cents from earning $7 an hour. He kept those habits up when he earned more, later in life.

- The small compounding effect of decisions adds up over time. For instance, investing 15%, instead of 5%, of your income sounds like nothing. Over 30 years, however, it can make a huge difference.

- The vast majority of millionaire next door types don’t live in fancy houses.

- There is a new rich these days, which is different to 1996. The dig economy has created a sub-section of people with 2-3 incomes. For example, they are a teacher + occasional uber driver. This demographic is increasing and a surprising number are actually reaching $1m.

- $1m in 1996 is worth about $1.5m now. However, that doesn’t change the statistics that much. There are more millionaires in the US and around the world, even adjusted for inflation, than 25 years ago.

- The wealthy need to focus on unearned income eventually, and not just earned income.

- The same basic skills, habits and behaviours that can lead to a $1m portfolio, aren’t affected by the economy, technology or elections long-term. The fact we had a financial crisis in 2008-2009, and yet more “millionaire next door types” have been created, is testimony to that.

- 70% of millionaires in the survey said they had always been frugal, meaning they spend a smaller percentage of their income relative to most people

- Small business owners, alongside the mid-income salary earners, are more likely to be millionaire next door types.

- Many of the sons and daughters of millionaire next doors, didn’t even know their parents were rich, until they die. One person inherited $10m but had no idea his dad was wealthy.

- The biggest thing stopping people from becoming financial independent is external pressure from friends, family and society to have big houses, cars and fancy lifestyles. People who give into this external pressures, become easy pray for marketers.

- Thinking differently has always been a trait of millionaire next doors and that hasn’t changed since 1996. Examples included in the book include people who have decided to live in smaller towns and cities, and “live like a poor person” in the eyes of many of their peers, rather than caring what the rest of society thinks about them.

- People shouldn’t be waiting on a radical government to save them and instead should focus on their own behaviours.

< DOWNLOAD THIS SUMMARY IN PDF HERE >

< FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website