JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

The Armchair Guide to Property Investing: How to retire on $2,000 a week by Ben Kingsley and Bryce Holdaway

You may be surprised to learn that you don’t need to accumulate a 10+ property portfolio to create a $2,000 passive income in your retirement. Nor will you need to spend more than 10 hours a week managing your portfolio when you have everything in place. Sound easy? Well that’s why it’s the ‘Armchair’ guide. Of course, when you’ve started your early retirement and are enjoying this level of passive income, you’ll probably spend your time travelling, having fun with family and friends, enjoying your sports and hobbies rather than sitting in your armchair! Readers are given all the fundamentals about investing, money and risk management, as well as the tools to get them started. Learn how to build portfolios which will deliver $2,000 weekly income in your retirement.

Each year, more and more reports are released suggesting very few of us will have enough savings, superannuation, and investments to comfortably retire on.

Many will be forced to work longer in order to fund their retirement.

20 percent of our population own over 60 percent of our private wealth and sadly the bottom 20 percent of our population only own just 1 percent of Australia’s private wealth. The top 20 percent control over 40 percent of all income and the lowest earn just 7 percent.

If you invest wisely, you can potentially reduce the need to earn more income, as the money you have invested does the heavy lifting, instead of you doing it.

If you want blood-pumping adrenalin, go jump out of a plane! Successful property investing should be predictable and boring.

Zig Ziglar. He said, “You can have everything you want in life if you just help enough other people get what they want”.

PART ONE: FOUNDATION

The state of our wallet plays with the state of our mind.

Property investing is a process, not an event.

Your mindset has a massive bearing on your ability to invest successfully.

Most Australians who cut corners wonder why they can’t get ahead.

Understanding and nutting out your own personal belief systems around property and the psychology of investing will help you in the long term by allowing you to make sound, measured and qualified decisions.

We all want the freedom that a passive income affords us but there’s a difference between the people who ‘do’ and those who ‘wish’ and that’s something we’ve been saying for decades: the doers know that a financial goal without a date is just a dream.

1: BUILDING YOUR OWN KNOWLEDGE BASE

Any talk of ‘money’ and ‘wealth’ is actually a discussion about what’s important to you to achieve a fulfilling life.

In Western society, money is seen as the number one benchmark of success.

Money is a somewhat of a taboo topic. We’re taught not to brag about how much money we earn. This is seen as crass or vulgar. On the other hand, nobody likes to share their struggle with money socially because it’s seen as a sense of failure if we can’t manage it or control it. There is also the fear factor. People allow money to control them and they lack the confidence or ability to manage their money. Furthermore, people get too caught up living day to day, month to month and year to year.

How are our attitudes to money formed?

Our attitude to money is molded by a number of sources, but in our experience, it’s our immediate circle of influence. It’s mainly through our parents, our parents’ friends, our grandparents, our childhood friends and their parents, as well as our exposure to media and advertising. So it just goes to show that the apple doesn’t fall too far from the tree, and it’s likely the people closet to you have conditioned your attitudes.

The ill-informed opinions of others that have the biggest impact on our views, use of money and our investment results.

Unfortunately, nine out of ten Australian households think they manage their money well. They’re living in a fool’s paradise if they believe that because only around 5 percent of our country’s population retire financially independent.

Attitude to money is completely individual. It’s personal. It related to what you want and your life ambitions. The greater amount of wealth you have, the better the chance of having an enriched and fulfilled life, because you have time to pursue your passions, goals and personal values.

BRYCE’S MINDSET MESSAGES

The desire to really live a ‘full’ life should get you past the fear of money and investing for wealth. Most people’s greatest fear is the fear of doing nothing.

It’s undeniable; we need money and wealth, you’ll have more time to pursue your dreams and enjoy your financial independence.

Positive money attitudes and habits can be learnt.

Don’t let in any further ‘interference’ from ‘well-wishers’.

2: THE PSYCHOLOGY OF INVESTING

Largely, as humans, we take action based on a simple ‘greed’ or ‘fear’ basis.

In a wealth-creation sense, the fear of not having enough money at retirement could be the spark for action. For others the desire to have riches is a greed factor.

When we meet a client for the first time, and design property investment plans for them, we go through a number of processes.

We call this process the ‘Four Foundation Levers.’ The levers are:

Income

Expenditure

Time

Target

The truth is that most people are living too much for today and not living enough for tomorrow, which is where they make their first mistake.

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

3: FIVE ESSENTIAL STEPS TO START

A doctor follows the same five-step process we recommend all property investors should take.

- Clarify. First, they clarify your situation by asking you leading questions about what’s going on.

- Evaluate. Then, they evaluate your situation, based on all the information they have gathered by talking to you and using their intuition, experience and training to reach a diagnosis about how they can help.

- Plan. Next they give you a plan, e.g. a prescription or an exercise program, based on what they’ve clarified and evaluated. They also ensure you have understood and agree with their plan.

- Implement. You walk out of the doctor’s office and are advised to implement their recommendations.

- Manage. Finally, you are requested to come back in a week’s time. This allows the professional to manage your treatment. You tell them what you’ve done, based on the process and the results. It’s important to note that the doctor might fine-tune the ‘manage’ step, and ask you to do something else, so it becomes a circular loop until you get better.

OPPORTUNITY

The first two steps are about looking at the bigger picture, creating a space in your life to take a snapshot of where you’re at and where you want to be tomorrow. These steps both take into account your mindset and the four foundation levers, which we’ve just covered.

- Clarify – today’s preparation determines tomorrow’s achievement.

The first step is about understanding you and your household’s opportunity or potential.

On a practical level, it’s about collecting information about your story, both from a personal and a financial perspective. Then it’s about goal-setting and looking at a short-, medium-and long-term perspective centered on what you want to achieve. This is vitally important because it will give you an understanding of what money will do for you, it will help you identify and communicate your goals and where you want to be in your life today and well into the future.

This step is about not just gaining a baseline understanding of your life, but it is also about getting down into the detail:

* What do you spend on running your household (bills, food, etc.)?

* What are the costs of running your car?

* What about your phone costs?

* How about your hobbies, such as your gym membership?

* Where is all of your money going and what’s left at the end of the day?

To begin to clarify, you need to start with the ‘destination’. You might have a dream, but you might not have defined it with a goal. So what’s your dream?

* Financial freedom?

* More time on your hands?

* To save for a major event, a wedding/honeymoon?

* To be wealthy?

* To retire at 50?

* Be debt free?

Then what’s your strategy and preferred investment vehicle to get there? That’s the goal(s) and that’s what you need to clarify. Once you have clarified your dreams and goals, you can move through to Step 2, evaluate.

- Evaluate – Success is a science.

This second step is all about looking at your opportunity and potential by crunching the numbers to help you make good on your goals. But it’s just as important to understand the future challenges that arise in your life, such as cash flow, which will affect your ability to achieve your goals.

So this where we get int the numbers. Generally speaking, our process is to measure cash flow movements every month for at least 40 years. Understanding cash flow is where the real art lies in successful property investment because it usually involved debt management as well. When we can evaluate, we can really start to show how a plan can take effect.

In order to evaluate effectively, we need to cover off three areas:

1) The money basics. Putting food on the table and keeping the lights on.

2) The surplus money. This leftover cash often goes to lifestyle but can also be put into savings or investing.

3) The bucket list. This can be equated to the ‘big rocks in the jar.’ What are the must-do-before-you-die things?

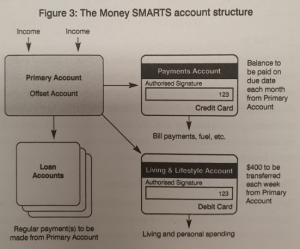

Money SMARTS

Our system to help you to better manage your money. It comprises a number of key principles designed to maximize the return on your money, as well as a recommended account structure to help you take and keep control of your cash flow.

S- Surplus

Your surplus money or cash flow is the starting point to create wealth. You simply cannot build a wealthier tomorrow or financial independence without it. It’s where you capture that surplus and put it to work in either savings, paying down debt or investing it that really counts. Surpluses are established by typically working through and analyzing your cash flow (income and expenditure), and it’s here where you’ll really start to understand your money’s potential to make more money.

M – Mindset

The trick is to adopt what we call the ‘money mindset’. By this, we mean the ability to accept money simply as a commodity – an available and useful tool.

Some see money as a rare beast; scared to spend it so it sits in bank account without earning or generating maximum wealth. At the other end of the scale are those who have no idea about what money costs, and opt for a life lived on credit, continuously buying lifestyle goods that over time lose their value or even become worthless.

You must conquer the first step on your road by answering this question: ‘Am I going to control money or is it going to control me?’

A – Application

This is all about you and your ability to make a real effort, by firstly taking an interest in your money, secondly making it work harder for you by establishing a plan and thirdly, being disciplined to see your plan come to life.

Application is all about staying the course, even when there might be the odd detour.

R – Resources

When we talk about resources and money management, we’re referring to both human and technological resources.

Technology is also a fantastic resource. Technology is changing the way we track our money and more options in this space are becoming available each year.

T – Timelines

A simplistic money model doesn’t account for the many timeline events we need to set aside money for having kids, losing our jobs, buying a new car.

That’s why best practice money managers are fantastic at modelling long-term timelines which take into account upwards of 40 to 50 years from now and cater for when you are going to need money and how much.

S – Strategy

With the right strategy in place, all of the previous elements will be brought into the fold to deliver the overall money plan to be executed; from initially structuring your money and finances, then measuring surplus cash flows, to getting your mindset right and committing to the journey and the discipline required to know the resources and timelines in play. Remember the tactics will win the battle but the strategy will win the war!

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

The Primary Account – The Heart

This is where the Money SMARTS system starts. Essentially, all of your income should be directed into this account and money should be taken out of this account to fund your expenses. The goal is to use it to capture your surplus income and direct it to where it will deliver the best outcome. This could be your mortgage offset line of credit or high interest savings account depending on where you are currently sitting on your journey.

The Payments Account – Credit Card(s)

Setting up a credit card to pay off regular bills and vehicle expenses, you can potentially utilize the banks’ interest free periods. This allows you to keep your money in the Primary Account for longer, giving you a better outcome overall.

The key is to ONLY use it for regular bills and vehicle expenses, not for unplanned or unexpected expenses, such as gifts, clothing, restaurants, luxury items.

The Living and Lifestyle Account – The Fun Money

Any time we need discretionary money to head out for dinner, for birthday celebrations or presents, this is where it comes from.

The best way to set it up is to open a Visa or Mastercard debit card with an automated transfer from your primary account on a weekly basis.

Action

Back now to our five-step process, the next two steps are about action.

This is where you get to put into place everything you’ve learned from the previous steps and really get cracking.

- Plan – if you fail to plan, you plan to fail.

If you’ve successfully managed to clarify and evaluate where you’re at, you’re ready to start planning.

When it comes to creating a timeline for the next 40 years, this may seem even more daunting! The truth is if you don’t have a documented plan, then you plan to fail. It’s as simple as that.

The two crucial aspects to the plan stage are strategy and tactics.

We believe there are two metrics to help you plan your household:

1) Surplus cash flow; and

2) Measure of household liquidity.

- Implement – turning best laid plans into action

Review

- Manage – what gets managed gets done

Manage is all about ‘measured and monitor’ and checking in; it allows you to take a step back and have a good look at what’s been achieved and benchmark those results against your plan.

Property investment is not something where you can just buy the paper every weekend and check out whether your stock levels have gone up and down, which plays with your mindset. Instead, great property investment should only take about 10 hours per property a year to manage – from your armchair!

Property investing is a game of finance, whereas buying your own home is a game of bricks and mortar. Just because you live in a property doesn’t mean you know how to invest in one!

PART TWO – THEORY

“An investment in knowledge always pays the best interest.” – Ben Franklin

4: THE FUNDAMENTALS OF INVESTING

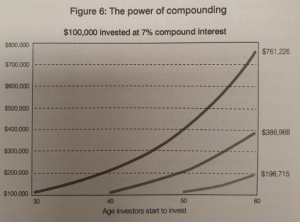

The reality is that the earlier you start investing, the better off you’ll be.

Both time and timing are fundamental to building wealth.

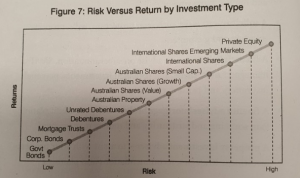

Risk is another fundamental factor. Everything involves risk and when it come to money management and investing, the stakes can be (and are) high.

If we’re talking risk, it’s also important to mention personal risk. You are the most valuable asset in your life, so you need to ensure you are protected as best you can be. You need to take adequate insurance against any adverse life events that will materially affect your portfolio building, such as sickness and/or temporary loss of income.

How do you create wealth?

Creating wealth has several components and variables, but essentially it’s created by:

* Accumulation. This is your ability to acquire more assets, income and savings, which builds greater wealth for you over time.

* Growth/return. The measure of the increase (or decrease) in value of your assets over a period of time.

* Protection. This is all about the ability to protect the value of the assets. In good times this should result in the value of the asset growing and in the tough times it should limit the downside risk of the asset losing value.

* Time, risk and skill.

Generating money

There are four ways we access or generate money.

Work

This is the most obvious way to obtain money. You can work as a PAYG employee to earn income or you can be self-employed and earn money through income or profits from your own business. We give up about a third of our time working on the tools to earn money, and for most of us, it’s our primary money generator.

Charity/government support

These are charitable donations or government pensions.

This book is all about becoming a self-funded retiree, where you take control of your destiny and you get to choose how much you are going to live on.

Investment returns

This is monetary return from income or increase in capital value. Examples of this include the interest earned on savings with your bank, dividends from shares held, rental income and increase the capital value of your investments.

Borrowings

It’s about accessing money via borrowings to build greater wealth. Fundamentally, most businesses operate by borrowing money every day to fund and expand their operation.

Influencing the value of money

Establish whether money is controlling you or you are controlling it.

Money costs or controls us in different ways. Do these ring a bell: living costs; interest on personal debt, credit card interest, car loans, lifestyle debts; inflation; tax? These are all costs and in a way they control us because we have to pay them back.

Inflation for example, plays a big part in the value of money, but because money loses value over time due to inflation, it’s not often understood by most and can be hidden cause for people not achieving their wealth goals. Basically, inflation is defined as a general rise in the level of prices of goods and services.

- Capital growth is basically when the demand for the asset pushes its value higher; and

- Income or yield is when the asset produces an income which could be in the form of rent, dividends or interest earned from an investment.

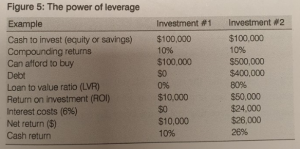

Two of the best ways we use money as a means to accelerate the wealth outcome of an investment. These are leverage and compound growth.

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Leverage

Leverage is the controlled use of borrowed money to purchase part or all of an asset in the hope that it’ll make a profit that’s more than the interest payable on the borrowings.

Compounding

The legendary scientist Albert Einstein said compounding was “the most powerful force in the universe”, he also deemed it “the eighth wonder of the world”.

Compounding is essentially the ability of an asset to generate its own earnings, which are then reinvested to generate their own earnings. It can have an excellent impact on your financial position because the growth earned over a period of time is added to the collective principal amount.

Investing

First, why do you need to invest? Perhaps some of your values are listed here:

Greater wealth to provide a better quality of life during the middle and retirement years.

Less reliance on government handouts, such as the pension.

Opportunity for ‘future choice’ and/or to retire earlier.

Ability to provide a better standard of living for your family, as well as for future generations.

Philanthropy.

Access to better health care services in the future.

Investment choices

Let’s consider the types of available investments. Essentially, these include:

- Fixed interest/bonds

- Cash

- Direct Property

- Shares

- Alternatives – Real Estate Investment Trusts, agribusiness, wine, art, antiques, collectables, coins, etc.

Typically, you’ll have a team of investment professionals to support you along the way, which might include:

An accountant – with experience in trusts, companies and self-managed superannuation funds (SMSFs), tax minimization and money management.

A Solicitor – to assist with asset protection, wills, property transfers and guarantees.

A financial planner – advise on superannuation, SMSFs, managed funds, shares and regulated investments, personal insurances and pension planning.

A finance adviser/mortgage broker – for your credit planning, loan sourcing and structuring and money management.

A property investment adviser – to assist with your property investment strategies, recommendations and planning.

A buyer’s agent – who will be responsible for selecting, negotiating and securing investment-grade property assets.

All of these professional will be equipped to help you get the ball rolling, but you’ll also need to think about where you sit as a long-term investor.

5: THE PROPERTY INVESTMENT FORMULA

Our Four Pillars of Property Investing formula.

A – Asset selection

You probably think you’re pretty good at choosing a property to live in for yourself, but what’s difficult to acknowledge for the amateur investor is that buying a property to live in is simply a game of bricks and mortar. Buying a property to invest in is a game of finance – and there is a big difference – and the two are not to be confused. So the question is which one do you choose?

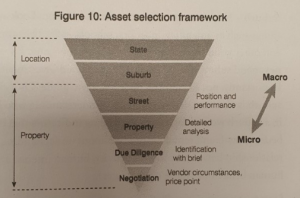

Location

For us, it’s never about the property first. Successful asset selection is always about the location and we start with this and work backwards from macro to micro. A good rule of thumb is that if you’re investing for growth, 80 percent of your return will come from the property’s location and 20 percent from the property. In other words, location does 80 percent of the heavy lifting, and you get the cream from getting the property selection right.

BRYCE’s Food for Thought

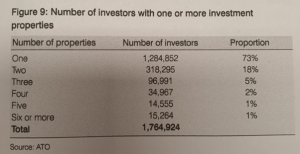

Here are some interesting stats for you: there are 9.4 million dwellings in Australia, more than 15,000 suburbs and 2,500 + new properties coming onto the market each week. Not all suburbs are investment-grade, and of the investment-grade suburbs, not all of the properties in that suburb make a good investment. So the question for every investor is: which one should you buy?

Asset selection summary

The take-home message here? Start with the big picture in mind, not the property. If faced with the choice between suburb vs property, always choose suburb first. It’s the ONLY way you’ll really understand how the property will likely perform. Start with the state, move on to the investment-grade suburb and then get down to street level. Don’t get distracted by the shiny taps!

B – Borrowing Power

One of the key things you’ll need to get your head around is having access to money.

Money is the vehicle to build your property investment portfolio. If you have borrowing power, i.e. the opportunity to borrow money when you want, this buys you the chance to put your portfolio into another gear. On the flipside, you could have great real estate, but if you get borrowing power wrong, you will hit your lending limit sooner than you would have hoped.

What do we mean by borrowing power?

Borrowing power is the combination of your income and surplus cash, and then seeing how much money you can borrow to acquire property. The idea is to have the smallest amount of your money and equity working to control the biggest property asset base, while at the same time not putting financial strain on the household. Get it right and you’re well on your way to a very enjoyable retirement, but get it wrong and you’re right back to square one.

How do you get borrowing power?

For the most part it will come down to one word – income. If you have regular, secure income, doors will open and you’ll be able to build your property portfolio, so long as you can of course cover your costs of running your household.

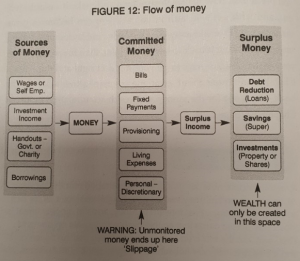

C – Cash flow management

This is possible the hardest part of the Four Pillars property formula to get right, because good (and great) money management all starts with cash flow. If you can harness it correctly, it’ll allow you to trap the surplus in your budget to really help you on your path to wealth creation and successful investment.

Without surplus cash flow you can never invest, period!

Your advisers can only take you so far. They can indicate where you’re at in terms of your household money and cash flow, but ultimately the hard work needs to come from you, because only you will know the actual numbers required to make the whole system work. Added to this is that everyone has different ideas of what constitutes cash flow management.

Step 1: What are our sources of money?

The first step to effective cash flow management is to take you back to the start – where does your money come from? At its most fundamental level, everyone has different avenues for earning money, whether that’s as a self-employed employee, or a PAYG wage-earner.

Your committed money is where your money goes, which might be to your bills, payments and other provisioning. But it’s also where the unmonitored spending occurs, and where you are most likely to run into problems because it takes into account your living, lifestyle and discretionary spending.

Tracking the money that’s left over – your SURPLUS income – is the aim of the whole exercise. Ultimately what you do with this money will determine your level of wealth in later life.

Step 2: Budgets

Here’s the funny thing about budgets – they simply don’t work alone.

It is a static look at money and cash flow.

Replace the need for a static budget and start thinking about allowances.

Step 3: cash flow simulation

So it’s out with the static budget and in with the ‘great’ money management solution of forward projecting your cash flows.

Step 4: Modernizing the jar system (allowances)

Work out what money allowance you need for what things each week

Flour Jar 1 – Living and Lifestyle Account – Visa or Mastercard debit card

Flour Jar 2 – Primary Account (offset account)

Flour Jar 3 – 55-day interest-free Credit card Account

D – Defence

The final Pillar is ‘defence’. While everyone loves asset selection, the love is not so widespread for defence. That’s because while the investor is usually so consumed by the accumulation of the assets, they often don’t realize that they themselves are actually the most important asset.

The easiest way to think about this last pillar of defence is with another word – protection. So defence is all about protecting two things: one, the property asset, which could be covered by taking out building and landlord’s protection insurance; and two, protecting you, the income generator.

Insurances to protect your income and your lifestyle. Insurances you need to consider are life insurance, income protection insurance, and total or permanent disability insurance.

If you go to the effort of creating a well-defined and well-performing property portfolio without the right defence in place, you’re really leaving yourself vulnerable to outside influences that could have a very serious impact on your future wealth you had done so well in planning for. If your income stops then so does this investment strategy given leverage is involved.

6: THE PSYCHE BEHIND THE PRICE

Here, we want to show you the science behind what makes an ‘investment-grade’ property.

To grade a location and then a property as ‘investment-grade’ requires in-depth research, assessment and a true understanding of value drivers within each property market. There are so many variables that influence property values, and it’s incredible how many people get this wrong.

One of the great aspects we love about property is that it’s bricks and mortar. It’s tangible. You can see it, touch and control it, as you own it outright. We’ve said before that we favour property over all of the other asset classes because we believe over the long term it is the best vehicle for sustained wealth creation.

It’s one thing to grab the paper on the weekend and look at properties that tick a few boxes, but it’s quite another to actually understand why a property is priced a certain way and make a decision as to whether it will be investment-grade.

To examine the various market mechanisms, we’ll first consider the supply and demand side of the conversation, and then the critical data indicators underlying both when it comes to investing.

Supply

This is all about making the right decision based on the land and accommodation stock available. In the land category, your first options is to buy vacant land, i.e. farmland

The second most common land supply is the availability of possible subdivisions. This is about looking at what’s around now and then looking at that longer-term availability.

If we move away from land stock towards accommodation, we start to talk about property household types. Besides stand-alone dwellings, we can also consider the current availability of high-rise accommodation, usually apartments.

Below is a list of critical supply considerations you need to consider:

Existing availability of vacant land

Future availability of possible subdivisions to enter market

Current availability of accommodation (by property household types – sale and rent)

Future availability (planning approval of stock to enter market by property household type)

Lead time and speed at which accommodation can be established.

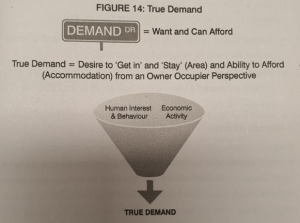

Demand

By demand, we mean ‘true demand – the ability of owner-occupiers to realistically afford what they desire. In other words, their desire to get in and stay in particular area and their ability to afford the accommodation.

From an analysis perspective, true demand translates as a combination of three key factors.

- Economic activity

This is the first thing to consider. What is the broader economic activity and what shape is it in at the time? Essentially, where do people get their jobs and how likely are those jobs to be secure?

- Human behavior

This is about getting into the psyche of the buyer. In our case, we’re more interested in the psyche of owner-occupiers because they buy on emotion and desire (i.e. with their heart), as opposed to the investor who’s investing for a return (i.e. with their calculator).

Delving a little deeper, this is about image and the way property represents us and who we are. It includes factors such as:

Status. Buyers can be attracted to properties in blue chip areas so that they will be perceived as successful.

Stigma. An area might have an associated stigma because it attracts crime and a lower socio demographic, and this can put off buyers.

- Human interest

Smart investors ride on the coat-tails of owner-occupiers who want to live in a particular location, because that’s where they’re going to enjoy longer, sustained returns, as opposed to returns on risker ventures which experience boom and bust-type cycles. When we talk about human interest, we want to know about all the things that make an area a pleasure to live in. Commonly, these are:

Demographic profile and suburb status

Lifestyle and amenities

Access to public transport and/or good transport nodes

Proximity to the CBD, shopping strips or centers, restaurants, cafes, bars

Proximity to the beach

School zone inclusion, which is attractive to families.

The risk is that you buy a dud, under-performing property because you failed to consider the psychology behind the price.

In summary, the more demand you have, the higher the likely rate of value growth of the property. The lower the demand, usually the lower rate of growth in value.

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Property Indicators

The three key indicators are:

- Marketplace indicators: These indicators measure market activity.

- Demographic indicators: These look at profiling factors.

- Human nature indicators: These measure human interest and human behaviour.

Marketplace indicators

These are some of the key lead indicators:

- Stock on market

- Stock for rent

- Property search portals – area searches

- Auction clearance rates

- Planning approvals

- Infrastructure approvals

- Vacancy rates: sourced from property search portals such as Realestate.com.au or Domain.com.au

- Days on the market

The key lag indicators to watch out for include:

Median values reported

Vacancy rates: as a lagging indicator, vacancy rates rely on industry reporting, and are commonly two to three months old before they’re released. The outcome is that you receive a false impression of the market.

Financing activity: this falls into a similar category as a vacancy rates because the RBA and the ABS delay the release of their stats on financing activity.

Search portals such as Realestate.com.au and Domain.com.au are getting better at publishing property data. Other great information and data sources include: CoreLogic RP data and their Property Value internet platform.

Good sources of on-the-ground information include that provided by valuation firms Herron Todd White (monthly reports) and Charter Keck Kramer, as well as national property investment monthly publications such as Australian Property Investor and Your Investment Property magazines, the online Smart Property Investment website and the broader personal finance Money magazine.

Demographic indicators

Next up are demographic indicators. Simply put, the most powerful component that drives value is people’s ability to afford it. So the following profiling factors – which take into account income, age and education mix – all play a part in the income component required to achieve an outperforming result when you locate areas and properties:

Suburb/LGA (local government area) household incomes and ages

Suburb/LGA education and occupation mix

Lifestyle and transport amenities

Employment and income prospects (short and long term)

Access and speed to mass employment centre(s)

Education facilities

Localized population forecasts.

The best source for demographic indicators is the Australia Bureau of Statistics (ABS).

Another great source is .id. (http://home.id.com.au) a company that forecasts populations and profiles demographics.

BRYCE’s Tips

Your returns are really governed by the area in which you buy. As a general rule, we think it’s an 80/20 spilt, where 80 percent of the return is derived from the area you buy in and 20 percent comes from the property itself.

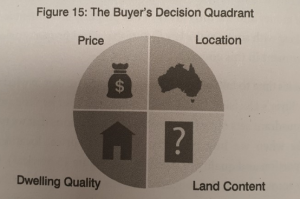

7: A BUYER’S DECISION QUADRANT

Comprising four key components, the quadrant sets out a framework for the decisions that we typically make when we buy property. These are: price, location, land content and quality of dwelling.

Location

Location is key and that is why we always put location as the first and most important component of the buyer’s decision quadrant.

The location does 80 percent of the heavy lifting.

Location is king from a return-on-investment point of view. Don’t be like the vast majority of investors who choose property type first and suburb second; it should definitely be the suburb first and then buy the best property you can comfortably afford in that suburb.

While location is the first consideration, it’s also the hardest to get right. This is because you need to assess ‘true demand’ which means working out the areas that are sought-after for the right reasons.

The key things we look at to establish ‘true demand’ are what does the area offer residents in terms of lifestyle and employment – the opportunity to earn income?

Now the interesting aspect to location when it comes to investing is that we’re really riding on the coat-tails of the owner occupier. As we mentioned earlier, they’ve already done the hard work in creating demand for the areas they want to live in, by paying sustained emotional values for those properties. Now it’s our job as investors to capitalize on that by swooping in and buying the assets that we know will be sought-after by the marketplace.

BRYCE’s Location Tip

Another interesting tip for choosing a location is to look for ‘gentrification’. This is where wealthier people are moving into a specific area that was once un-down and often ‘blue collar.’

Price

If the location is usually the first thing buyers look at, then the cost or price of the property is next, and it’s typically the most inflexible aspect of the quadrant.

The budget is an important factor to consider – especially as investors – and there are two key questions you’ll need to answer in order to satisfy this part of the framework:

What does your household believe it can afford to buy today?

How will you sustain that asset over time?

You need to remember that at its heart, property has significant costs to get into and these are even more significant when you want to get out.

Land content

You need to think about land proportion as property type. Whether you opt for house and land 20km out of the city, a mid-rise development or a single-dwelling property, the important question to ask yourself is what your money will buy you within a desirable location. As well as how much land you can afford in that location.

The important thing to note here is to buy the best property you can comfortably afford in the highest land value area. If you can afford a house then great, but if you can only afford a townhouse or an apartment then don’t see this as the booby prize. See it as a great opportunity to stay in the location and buy the best investment-grade property you can get your hands on.

Dwelling quality

Is the property the owner-occupier is considering shiny and new, appealing to the elevated status you want to achieve, or is it dated and fusty – the perfect ‘ripe for renovation’ property that you can live in short term but has the option to upgrade in time?

Remember, 70 percent of the market is controlled by owner-occupier buyers – emotional buyers. They set the area price and as investors we simply ride on their coat-tails.

It’s also worth considering what kind of investor you want to be, because there are a number of different strategies you can adopt. Essentially, it all comes down to whether you want to be an active or passive investor. You need to work this out because your property portfolio success hinges on whether you would rather sit back and watch the rental income come in and the investment value steadily increase (passive), or you’d prefer to get your hands dirty by taking a much more proactive approach (active). With the more proactive approach, you’ll be looking to manufacture growth in equity and/or income by adopting value-add strategies to maximize the potential of your portfolio.

PART THREE: ACTION

“Success is nothing more than a few simple disciplines, practiced every day.” – Jim Rohn

8: LEARNING ABOUT YOU

You’ve made the decision to join the many Australians who enjoy property investing as their preferred vehicle to reach their financial goals. Next up, you need to work out two key components:

- Investor considerations – relating to your ability, desire, skill and experience as an investor.

- Tactical considerations – the variables which make up part of the implementation process. These include research requirements, cash flow position and investment outcomes.

Investor considerations

What are your levels of knowledge, experience and qualifications?

Here’s a universal truth about human nature: people will choose the ‘line of least resistance.’ But as with anything in life, the more you put in the more you get out. It’s the same for property investment.

What is your level of risk?

It’s critical to establish your own level of risk that you feel personally comfortable with. No one can make this decision for you but it will affect the strategies available to you, so it pays to think long and hard about this from the start.

How much time have you got to spend?

What sort of investor do you want to be?

How long do you want to be in the market?

What’s your current wealth position?

Tactical considerations.

How much time do you need to spend on area/location research?

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website

BRYCE’s Tip

Remember! Effective searching is not just about logging onto real estate websites and sipping on a latte flicking through properties and areas. Start from the ‘macro’ at state and city level, and then move onto ‘micro’ – suburb, localized neighborhood, street and finally property.

How much time do you need to spend on property research?

What’s my cash flow and borrowing power – what price point can I buy for?

When’s the right time to buy?

What about the tax implications?

9: 18 INVESTMENT STRATEGIES

Remember though that property should only require 10 hours per property per year to maintain if you are a passive investor.

Our 18 strategies each fit into one of these four categories:

- Area strategies for capital growth

- Property selection strategies for capital growth

- Area strategies for yield/income

- Property strategies for yield/income

Area strategies for capital growth

Strategy 1 – The Proven Performer

The Proven Performer offers a reliable and regular performance, featuring a property location with very consistent longer-term capital growth over an extended period of time – say 30 years.

Strategy 2 – Rare Earth

Rare Earth is about investing in and understanding land and its relation to appreciating values and scarcity.

Strategy 3 – Million Dollar Strip

These suburbs come under the ‘if I had unlimited money I’d live here’ category. These prize-winning addresses leverage off very high ‘status and bragging’ appeal, great ‘dress circle’ neighborhood appeal and wonderful street appeal, such as tree-lined streets, beachfront boulevard, etc.

Strategy 4 – Changing Places… Changing Faces

This strategy related to old, working-class areas as close to CBDs as possible. They are the areas that have been (or are about to be) transformed into hip and happening, urban renewal locations.

Strategy 5 – The City Fling

The city Fling is all about pure lifestyle locations loaded with amenities for young people, such as running tracks, cafes, gyms, the beach, music and clubs. These are inner-city locations with residents who are well educated and have strong disposable incomes for their age.

Strategy 6 – The Wave Rider

The Wave Rider is about identifying areas and locations benefiting from the successes of neighboring locations and suburbs.

Property selection strategies for capital growth

Strategy 7 – Scare Diamond

Astute investors understand the Scare Diamond very well. It’s when the actual dwelling itself has strong owner-occupier appeal, with character and period charm usually the order of the day. Crucially, growth lifting, just like a vintage car, rare coin or stamp that rises in value over time due to its scarcity and mainstream appeal. High demand means these beauties outperform in value growth return.

Strategy 8 – Ugly Duckling

This one’s an equity play with an active strategy, where you find a property with ‘good bones’ and in due course renovate or restore it, (but it can be livable in the meantime).

It’s usually the short-term, quick cosmetic equity gain harvest that makes this strategy so rewarding, because the gain can be turned into a further equity release to potentially buy another property, giving you a multiplier of wealth effect.

Strategy 9 – The Shoulder Rider

This one’s all about focusing on a unit purchase in the best location possible for the dollar outlay.

In the right locations you wan to aim for off-the-plan properties to set new price point records for that location – that’s how you should ride!

Strategy 10 – Renovator’s Mission

The Renovator’s Mission strategy is a hands-on approach, whereby you make structural changes in an effort to improve an existing dwelling and bring it up to a standard comparable to that of the majority of properties in that neighborhood. It’s really about making old new again! Your focus is on maximizing the potential equity gain here, which we call equity harvesting.

Strategy 11 – Reliable and Durable

It might not have the good looks, but it’s a solid investment that’s stood the test of time, age and internally it is very liveable, if a little worn.

Strategy 12 – Size Matters

Size Matters focuses on getting as large a block of land or dwelling as possible within the investment criteria that has been set out.

Strategy 13 – The Piggy Backer

This strategy is like the Shoulder Rider but it’s for houses instead of units. The same principles apply where you buy an older house that will piggy-back off the increase in new stock in that area, that sells for significantly higher prices.

Area strategies for yield/income

Strategy 14 – No vacancies

No Vacancies is all about finding areas where rental demand is tight, which means vacancy rates are low. These locations can offer higher rental yields due to the underlying demands.

Cities with gross rental yields of 5.5+ percent combined with vacancy rates of less than 1 to 2 percent are prime opportunities.

Strategy 15 – The Boomtowners

The Boomtowner strategy is a pure area income play. They are usually mining or remote towns and communities that as a draw card, no one would live there.

Very strong rental yields of more than 7 percent.

Strategy 16 – The Non-Aspirers

The Non-Aspirers strategy is about finding investment areas where rental demand is high. These areas are usually found on the out-suburban ring and are populated by a high proportion of low-income earners and/or people of a low socio-economic demographic.

Property strategies for yield/income

Strategy 17 – The Double Up

The aim is to produce additional income streams from the one property, so think of the classic model of a granny flat or bungalow and you get the drift as to how this one works. It could also be transforming a double story dwelling into two homes.

Strategy 18 – The Slice and Dice

The Slice and Dice strategy involves sub-dividing land into separate titles or a property into strata-titles. It can harvest equity out of the existing land and allow for an additional dwelling or several dwellings to be built for further income purposes.

10: HOW TO EARN $2,000 A WEEK

Here are our six case studies for you.

Rentvestor. Our single person who is just dipping his or her toes into the investment market and stepping onto the property ladder for the first time.

DINKS. ‘Double income no kids.’ This growing market usually comprises a mid-30s couple without children.

Couple with young kids. This scenario is all about unlocking the equity in your home and putting it to work.

Older couple with older kids. Making up for lost time; there’s a bit to do here to make it work as you’re starting a little later than most.

Empty-nesters. These guys also fall into the ‘making up for lost time’ basket but we show you how it can still be done.

Divorcee. Facing the tough challenges of raising a family on a single income. We show you how to protect yourself but provide growth at the same time.

For a complete detail breakdown into the plan you are going to have to buy the book as it is too much detail for this summary. Grab the book now if you are serious about property investing in Australia.

JOIN THE ‘BEST BOOK CLUB’ NOW HERE

DOWNLOAD THIS FREE PDF SUMMARY HERE

STOP TRYING TO ACHIEVE YOUR GOALS BY YOURSELF AND BE COACHED TODAY HERE

CHECK OUT THE FOLLOWING Book | Summaries | Course | YouTube |Spotify | Instagram | Facebook | Newsletter | Website