DOWNLOAD THE PDF HERE: Jon Hanson Good Debt, Bad Debt Book Summary

★★★ Sign up to the WEEKLY Book Summary Newsletter by CLICKING HERE

★★★ Get any FREE Audiobook of your choice by CLICKING HERE

★★★ View the LATEST Products of the month by CLICKING HERE

Jon Hanson: Good Debt, Bad Debt Book Summary

- Debt keeps you working.

- Debt takes more than just your money.

- Injudicious use of debt is a character problem.

- Introduction: Are You Using Debt, or Is Debt Using You?

- Debt for consumption is bad debt, since what you have borrowed for is gone.

- Debt that enables you to safely set up a cash flow or return in excess of its cost is good debt.

- Your burn rate controls your fate-spending determines your ending.

- The worst debt is any debt or spending that consumes the last 10 to 15 percent of your monthly income – this keeps you from saving and investing for your future.

- You will never obtain financial freedom while addicted to debt and consumer spending. Wealth comes from accumulation, which is the exact opposite of consumption.

- Good debt is an outcome, not a type of debt.

- The classic “good debt” uses – real estate, education, or business – are generally better than any of the consumer categories, though many people go broke borrowing in these so-called good debt categories.

- Too much of a good thing can be a bad thing. Available credit can be like a powerful handgun. In the hands of someone trained and competent, it provides protection; a home intruder would have littles chance. In the hands of the untrained the gun may lead to the user’s own death.

- Management not cure. The process is to wisely use debt to position yourself in planning for retirement and continual education as you move through life.

- What Good Debt Is

- The wise use of good debt increases your net worth. Good debt helps you make money; the use of good debt adds to current earnings, net worth, or foreseeable earning ability. On the other hand, bad debt decreases your net worth. Bad debt consumes your money without a countervailing return. Payments on bad debt reduce cash flow. Compare:

- Good Debt

- Earn its keep

- Increases your net worth or cash flow

- Secures a discount that can be converted to cash or net worth.

- Creates a leveraged position with a strong margin of safety

- Examples: debt for real estate at a safely leveraged level, debt for education that can be sold in the marketplace, debt for a business you are competent to operate.

- Bad Debt

- Is typically for consumption or rapidly depreciating goods.

- Decreases your net worth or cash flow.

- Absorbs future earnings.

- Examples: car loans that rob your retirement fund; continuous credit card debt.

- Debt Indicates Character

- Character is the combination of qualities or features that distinguish you from others.

- Develop the character traits of good personal finance habits.

- Character is the ability to follow through on a worthwhile objective – even after the emotion that was present when the objective was proposed is gone.

- Debt becomes a weapon that we unwittingly turn against ourselves.

- In The Millionaire Next Door, Thomas Stanley and William Danko discovered that average self-made millionaires save or invest 15 to 20 percent of their disposable income.

- The past is the past – unless of course you still owe for it. Many can’t start up the hill of financial freedom because they are carrying a backpack full of debt.

- Confused thinking causes confused spending.

- Money Magazine writes that recent studies by economists from New York University have found that a willingness to plan is closely linked to wealth accumulation.

- Income of almost any size when strained through well-trained habits can create wealth.

- Money will just make you more of what you already are.

- Life is truly asynchronous. What you do today may not have an immediate effect but may have a very large effect later in life.

- Ready?

- Here are the things you need to do for financial success:

- Understand the debt effects – debt takes more than just your money.

- Manage emotions – deflect media influence.

- Work from a plan – monitor burn rate.

- Delay gratification – track and tabulate expenses.

- Save/invest for your future – what if you live?

- Chapter One: The Debt Effects: The Invisible Hand of Debt

- The culture of spend, spend, SPEND is necessarily created by merchants to keep their coffers overflowing. It has been said that more than 60 percent of the economy is based on consumer spending, in part financed by consumer credit. For those who collect the money, this spending culture is rewarding. For those doing the spending, it is enslaving.

- Not everyone has the moral or intellectual stamina to set into action a purposeful plan for the future. Yet only those who develop a plan and follow it will succeed.

- Those who live in a constant state of “want” become salves to their own passions. Many go further – voluntarily putting on the shackles of debt – not only spending all they earn but also borrowing into their future for today’s excesses. When we use debt to acquire products or services, it is not really a payment for the product or service, but a claim on future earnings.

- In its early stages, debt causes no pain. On the contrary, the insidiousness of debt lies in the very fact that the use of debt gives its victims temporary pleasure.

- Debt – the Equal Opportunity Enabler

- Credit to the untrained appetite distorts reality. It provides the emotions with vast avenues to explore. Credit allows emotions to trump math – stretching our purchases far into the future and reducing the “right-now cost” to a few dollars a month. Soon the emotions subsides and you are left with the reality of the math.

- Debt Takes More Than Just Your Money

- What holds us back from financial success? The most evident of my four debt effects, loss of cash flow, is easy to see; the others may operate invisibly. Capital seeks opportunity to expand and grow, as it is good for the individual owner of the capital and the consumer.

- The Four Debt Effects: The Four Thieves, or How the Invisible Hand Operates

- Always remember that debt takes more from you than just money.

- There are four major debt effects:

- Loss of Freedom

- Loss of Cash Flow

- Loss of Time

- Loss of Opportunities

- Loss of Freedom

- “Working while carrying a load of debt is like a prison work-related program. You are released each day to work, but the balance of your time is spent in a mental prison.

- Many people never realize the drudgery of their lives! If we can agree that entry into this cycle is voluntary, then it would follow that leading this lifestyle is also voluntary.

- Having a job is like taking a mortgage out on your life. Unless you are born wealthy, you must arrange your escape from drudgery at an early age. Born without wealth, you are at least a part-time servant and are unable to do whatever you want. It is up to you whether you remain in this voluntary servitude or arrange your affairs to carry yourself to financial freedom.

- Most of us unknowingly choose servitude when we buy into the popular culture of “you can have it all.” You can – when you have earned it. Spend the first ten to twenty years of your working career saving and investing 15 to 20 percent of your income rather than choosing to spend 15 to 20 percent of your income to service bad (consumer) debt. If you begin now, you will earn and deserve your freedom.

- Financial freedom is a lack of necessary worry or concern about money.

- When you are debt-free, the real freedom is not just what you can do, but what you don’t have to do. You are free from the invisible hand of debt.

- Loss of Cash Flow

- If you are spending 15 percent of income on bad debt, the first goal is to get that down to 10 percent, then 5 percent, and eventually nearly zero. Do this while redirecting the cash flow to savings and investments, and eventually this fund alone can replace your job. This won’t happen in a short time, but with diligence over ten to twenty years, the results can be amazing.

- You must have capital to capitalize!

- Many sacrifice their true passions to debt. Soon most of their money is allocated to “reparations” or repaying for past spending. Their passions dull into complacency and are soon forgotten. They lose simply by giving debt too large of a vote in their future. Remember, the past is the past, unless of course you still owe for it. It is hard to move forward while paying backward.

- Loss of Time

- If you’re in debt, you must be somewhere other than where you’d like to be.

- People who are deeply in debt – bad debt. They essentially have spent their time in advance, for they are obligated to be at their jobs to repay their debts. They have spent their time in advance of it arriving. This is what I mean by the term mortgaging your life.

- Freedom from debt and time with family and friends have begun to edge out weight loss as the number one New Year’s resolution.

- Many people desire free time more than additional money.

- Loss of Opportunities

- When you see a great opportunity for financial gain, it is unlikely that you will be able to take advantage of it, because you will be financially unable to do so. The first rule of all enterprise is to know a solid value when you see it. The second rule is to be able to act on an opportunity when it arises.

- Funds already spoken for must remain silent when opportunity knocks.

- For Whom Am I Working?

- Many people work hard to have luxuries – only to become slaves to those luxuries. In The Art of Money Getting, P.T. Barnum wrote, “Debt robs a man of his self-respect and makes him almost despise himself.” You may well ask, Do I have my possessions – or do they have me?

- The notion “I don’t make enough” is more popular than the supremely accurate notion “I have poor spending habits.”

- Those choosing to live hand-to-mouth will always be a financially inferior class compared with those who take time to plan, save, organize, and invest.

- Financial immaturity is the major reason that people do not plan for the future.

- Plan, Plan, Plan

- It is up to you to plan, study, and seek a wise and prudent life. If you don’t know how to become financially competent, you must ask until you do know. What a terrible cost silence imposes on ignorance. A Chinese proverb says, “He who asks a question is a fool for five minutes. He who does not ask is a fool forever.”

- You are responsible for your choices. Recast your habits and you will change your life permanently.

- Soren Kierkegard wrote, “Life can only be understood backwards; but it must be lived forwards.

- If you don’t change the way you think and act now, your financial future will look pretty much as it does today. But, if you take steps now, you can change the ending.

- Your biggest investment should be in your future. Your future is enriches by applied knowledge of your daily burn rate, retirement, education, reading, and study. A definite purpose, a desire, to have a certain future must be at the center of your plan.

- It’s easier to maintain the status quo than to strive for your dreams.

- Are you getting any rest being broke? For the most past, being poor is more tiring than treading the path to wealth. And the path to wealth is much less depressing. If you have a mind to improve your lot in life, keep in mind that inaction will wear you out!

- When you use debt to pay for something it is not a payment in full, but merely a claim on your future time and earnings.

- Good Debt

- Earns its keep

- Increases your net worth or cash flow

- Secures a discount that can be converted to cash or net worth

- Creates leverage position with a strong margin of safety

- Examples: debt for real estate at a safely leveraged level, debt for education that can be sold in the marketplace, debt for a business you are competent to operate.

- Bad Debt

- Is typically for consumption or rapidly depreciating goods

- Decrease your net worth or cash flow

- Absorbs future earnings

- Examples: Car loans that rob your retirement fund, continuing credit card debt

- Bad debt is money owed for trinkets, nonessential essentials, an excess of items, and other consumer junk. For example, a nonessential essential could involve paying $599 a month for a Lexus.

- Bad debt usually begins to pile up when we allow emotional spending or spending without regard to consequences. Without a spending plan in place and clear guidelines, we accumulate bad debt quickly.

- Plastic Crack

- Credit cards are the crack cocaine of the credit industry.

- The quick high or feeling of power from spending without earning is addictive – it’s a difficult to break.

- Carrying credit cards is like carrying a concealed weapon. In responsible hands, they benefit the owner; in the hands of the foolish, they are deadly. Couple with unbridled emotion, credit cards can eviscerate any rational financial plan.

- Bad debt is further defined as spending for debt that reaches into the last 10 to 20 percent of your monthly or weekly income.

- What could you do with all of the bad debt payments you have made over the past ten years?

- Paradebt

- There is another category I call paradebt or “almost debt.” This is the cumulative effect of all your nonessential monthly spending.

- Paradebt involves services like cable TV. There are voluntary monthly obligations that can be cancelled at any time. Realize that they are short-term debt. A debt is a debt. A debt is a debt is a debt.

- Bad debt can build up deposits in your cash flow arteries, and soon you could have a financial stroke.

- Good Debt

- By definition, good debt builds wealth. You will have slower financial growth without good debt, although, you could argue, much safer growth. Good debt allows you to leverage your savings and increase your net worth through wise investments.

- Good debt is debt on assets that provides a cash flow exceeding the amount of the debt service.

- Owning debt, not owing debt, is a way to become wealthy.

- Usually if young adults are broke and confused, it’s a sign that the parents are broke and confused or missing in action.

- In its early stages, debt cause no pain. On the contrary, the insidiousness of debt lies in the very fact that it gives its victims temporary pleasure. Sign and drive! No payments until next year! EZ payments!

- Chapter Two: Emotional Hostages: How Do I Get Free from Me?

- Without the sizzle, few steaks are sold

- Most every bad debt decision starts wrapped in the warm glow of emotion. Emotions is the spoonful of sugar that helps you swallow a lot of things that aren’t good for you. The main ingredient in all advertising is sugary emotion.

- Sizzle or sex appeal is the basis of most advertising. The implied message is the real message. It is not what you get – but what you think you get.

- What advertiser would dare show the underbelly of the beast? Reality is a tough sale and reality is not what they sell.

- Without emotional appeal, advertising would be pretty difficult.

- Clearly the path past your reasoning is paved with juicy emotions. It seems that juicy emotions distract the blood flow away from your reasoning capacity.

- In most instances’ advertisers must distract you from a plan that is better for you than what they are trying to get you to do.

- Your attention is easily gained when you are not on a mission.

- Either you edit what comes into your mind or the media and advertises do.

- Unless you are born very rich – to become wealthy you must have a period of sacrifice.

- The type of sacrifice I am talking about produces the great feeling you get when you promise yourself to do something and then actually do it. This is the definition of resolve: promising yourself that you will do something and refusing to quit until it is finished.

- If you choose not to make a choice, you still have made a choice.

- It costs more to put on an appearance of wealth than to take the steps to actually become wealthy. Wealth is not instant. Delayed gratification is the proper prescription here. This is especially true when you count the cost of financing the appearance of wealth.

- No one is worthless, anyone can at least be a good example.

- It’s a lot easier to learn from some poor sap’s experience than to volunteer for that tour of duty yourself!

- In a financial transaction, every unbridled emotion has an equal and opposite dulling effect on common sense.

- People give up of there assets to feed their ego.

- You are strong if you can conquer others; you are mighty if you can conquer self. The battle for control of your emotions is with yourself.

- People become slaves to their own desires.

- Even when debt is not accruing, we may engage in McSpending – promiscuous spending that we don’t realize counts until later when we calculate the cost. These are the small amounts of spending we don’t often account for. The five or ten dollars a day of petty cash leakage can add up to more than half a million dollars over twenty or thirty years. McSpending can be anything from the $3.50 Starbucks coffee to expensive lunches, while our IRA or retirement account lags.

- When you notice that enough money has passed through your hands and that just 5 or 10 percent of it would by now have grown to a fortune, then you are ready to begin learning. The best lessons in life can be learned but not taught. Sadly, they can be ignored too.

- Being emotionally successful means knowing and applying fundamentals. Fundamentals are principles that act in a consistent manner independent of your understanding, action, or inaction.

- The fundamental of compound interest will work for you or against you regardless of your understanding. Money is no respecter of persons; it works equally for or against all who will give it employment. With consumer debt, aka bad debt, compound interest charges work against you. With prudent investments, compound interest will work for you. Compound interest, like gravity, operates either for or against you.

- Since you may implement only what you are aware of, your awareness will determine your level of success. If we agree with the old adage that your attitude controls your altitude, then I hope that you’ll agree with me when I say that your awareness controls your possibilities.

- Fundamentals are principles that are time tested and proved by common sense. They will endure beyond our lives and those of our descendants.

- You can explain away your word, but not your actions. Are your actions consistent with your words? This is a constant source of grief for many people. Can you daily reconcile your words with your actions?

- Seek wisdom, discipline, and discernment.

- Have your noticed that the word rationalize has the sound of “rational lies”? People lie mostly to themselves. They think “someday,” “when I,” “then I will,” and other delusions. These are all mild sedation for the mind trying to ration lies to itself to explain away actions or inactions. “Someday I’ll” or “I’ll try” is the cheap drug people use to excuse themselves from sincere effort. Brian Tracy says, “I’ll try is excusing failure in advance.”

- Here are a few fundamentals for debt and emotion control:

- Get paper-trained! When you think about decisions, always do it on paper. High emotions lower financial acuity. If it doesn’t make sense on paper, it probably doesn’t make sense in practice. Planning is often the highest-return thing you can do.

- Learn to discern when emotions are swaying your decision-making ability.

- Think of rationalize as “rational lies.” Who are you lying to? Probably yourself.

- Be consistent. Keep your actions consistent with your words. Improve your words and actions.

- Self-select. Set your priorities and purpose or someone else will set them for you. You must self-select or take leftovers.

- Be Careful What You Wish For

- Many work to acquire luxuries, and then become slaves to those luxuries. We are born free yet entrap ourselves in a web of debt and time obligations that make us voluntary salves or at least pitiful employees of our creditors.

- When you allow yourself to be led by your emotions, you are not in control.

- Freedom is found in self-discipline.

- Freedom is found is restraint. Only through conscious choice can we begin to control our outcomes. You must self-select.

- Chapter Three: Burn Rate: Spending, Not Income, Determines Wealth

- Just as work tends to expand to the time allotted, spending, without restraint, expands to the amount of money available – or even beyond. It is hard to see spending as a problem while all of your existing needs and many desires are being met. Truly, we can’t see the problem for the solution. The tendency to confuse income with wealth is near an epidemic level among Americans. Income is like a moving river; wealth is like a lake or reservoir. Stored income is wealth; spent income may not even bring fond memories.

- If you consistently spend all you make, you will never be set financially.

- Many confuse needs or necessary expenditures with desires. Each of us has desires that far exceed our actual needs.

- Defining Burn Rate

- Your burn rate is the actual amount of money you spend each month to stay in the same place – your status quo. This includes all fixed costs of living and the impulse buying you do now and then. Your burn rate is the sum total of your financial obligations, plus spending on food, shelter, and any extravagances. Simply said, burn rate is all the money spent that does not increase your wealth. Burn rate is what is consumed and gone forever. Taxes are a major part of your burn rate, together with food, shelter, and transportation.

- Meet LERI

- You could also think of your burn rate as your fixed cost of existence. Only the portion of income in excess of your burn rate can be available to build wealth or attain freedom from toil. There is no secret to becoming wealthy – you must lower your burn rate or increase your income, preferably both. This is easy to remember as the acronym LERI – Lower Expenses or Raise Income.

- You must take the difference between burn rate and income and invest it wisely. It is only the portion of your income above burn rate that is available for wealth building or retirement.

- As your income rises, resist the temptation to ratchet up your lifestyle.

- We are all given free will, before debt, to choose where our resources will be spent. Once we have debt and large monthly expenses the four debt effects begin to rule. We experience loss of freedom, loss of cash flow, loss of time, and loss of opportunities.

- If you are forty years of age, every $100 a month you continuously burn costs you over $132,000 at age sixty-five.

- Burn rate is what you consume as in burn up.

- If your outgo exceeds your income, then your upkeep becomes your downfall.

- Many people have a form of wealth (income), but deny its power through lack of discipline and unbridled desire. These are the self-deluded pretending to be wealthy. I call them “goldbrickers,” as they try to project wealth on the surface, but when they are scratched you find the goal is really only gold paint on a common brick.

- We grow obese from shoving too much food down our pie holes – we grow poor from overspending and debt accumulation.

- Determine to deserve success.

- Your burn rate as a percentage of income is the most accurate predictor of your eventual success or failure.

- Most millionaires earned their money, delayed gratification, and controlled their burn rate.

- Wealth will only make you more of what you already.

- Here are some U.S. Bureau of Census statistics that are commonly batted about by inspirational and financial speakers when they discuss where many folks of retirement age find themselves:

- * Ninety percent are partially or totally dependent on government or family.

- * Five percent are self-sufficient.

- * Four percent are well off.

- * One percent are fabulously wealthy.

- As you get older, you many notice that you begin to value time more than money. This will be especially true once you begin to accumulate wealth.

- A job is a short-term solution to a long-term problem.

- Try saying to your friends, “I choose to have less now so that I can have more later!” Hard work alone cannot create wealth. Wealth is dependent on accumulation.

- It is how much you have left over after expenses (or burn rate) that matters.

- Money is indifferent to who owns it.

- We must have capital to capitalize. It is you burn rate, not your income, that will determine your fate.

- Success comes from long obedience in the right direction.

- Jim Rohn says, “With sight you see things – with insight you see answers to things.”

- Lower your burn rate. Get control of emotional spending. Make some very important mature life choices. No matter the amount of your income, wealth can be obtained, or even maintained, only through the amount you don’t spend.

- Don’t lose all your money, hard work alone won’t make us successful; we must accumulate capital and knowledge also.

- Chapter Four: Delayed Gratification: Don’t Wait to Get It

- Cicero wrote, “Not to have a mania for buying things is to possess a revenue.”

- Delayed gratification; spend less than you make; provide for your own future; put back more than you make; provide for your own future; put back more than you take; continue your own self-education; maintain personal responsibility and self-government.

- We have more people with poor spending habits than we have poor people.

- The very essence of delayed gratification is to stay the course until we meet with success uncommon to those who cannot delay their desires.

- While burn rate may be a mathematical and easily definable concept, the control of it is largely an emotional concept. The best ways to manage burn rate and delayed gratification are:

- * Measurement – Some us practice politically correct record keeping – we do not really want to know the truth. Continued deception is easiest if you do not have an accurate accounting.

- * Control of your emotions – This means delayed gratification.

- * A plan to follow – Continuous education is the key.

- * Delaying allows accumulation – a key element of wealth building.

- Delayed gratification is a math problem that is often distorted by emotions and desires distracting you from seeing a simple answer.

- How you spend your money is a moral concept as well as a practical test of wisdom. I think most of our ill-conceived spending begins in these four broad areas, all variations of Homo Consumerati:

- * Immature Consumerati

- * Emotional Consumerati

- * Selfish Consumerati

- * Ignorant (by choice) Consumerati

- Immature Consumerati

- These are the people who do not see that their actions and how they live their lives (spend) have a large impact on their families and the world around them. This type of spendthrift does not grasp the basic concepts of money: that we must spend less than we make, that our ability to earn is not unlimited, that time is not on our side.

- Emotional Consumerati

- This is the area that gets most of us. Our senses get excited and we believe, at least for the time it takes to spend, that having “things” will make us happy.

- Anything we do repeatedly that gives us pleasure begins to take control over us.

- Selfish Consumerati

- Their luxury sports car is more important than having the home paid for, the retirement plan set, or their kid’s education funded.

- The Selfish Consumerati are interested only in what immediately benefits them personally.

- Ignorant Consumerati

- Ignorance is like immaturity in that you may be unaware of it.

- The average twenty-first-century American family will handle more than $2.8 million over a forty-year period (based on 2002 figures; the actual amount will go up, adjusted for inflation). In seems ironic, given the amount of money we handle, that most people will end up broke and dependent on the government or others for their retirement.

- The sooner we take charge of our personal finances, the better off we will be in our inevitable and inescapable old age.

- All capital comes from the labor of the savers/investors of the Econowise. Labor comes in the form of brain work or back work. Capital comes from labor, and stored labor is capital: stocks, bonds, notes and mortgages, real estate, and cash savings.

- It is ironic that people will borrow money to make an appearance of wealth even though the payments for all of our toys, properly redirected, could lead us to actual wealth. With easy credit we begin to train an unnatural appetite that can lead us down the path to slavery. If you will delay gratification and begin to redirect your income to positive pursuits, eventually your wise money handling will allow you to afford the things you desire without pledging your future income to own them.

- This is a classic Consumerati move – make sure you are always heading uphill pulling a wagon full of debt.

- The Consumerati are very concerned with keeping up appearances.

- The Consumerati deceive themselves into thinking that “things” will make them happy. But what they find are only pleasures as shallow as the moment and despair as long as the payments.

- You choose to deceive yourself, to tell yourself that you will take care of your future later. Later is sooner than you think.

- The ancestors of the haves and the have-nots are the dids and the did-nots, respectively.

- Discipline delayed is discipline denied.

- While we wait to develop good habits, the poor habits become stronger and far less likely to ever be replaced.

- Pay as You Go

- Statistically, only 3 to 5 percent of the population will retire without being at least somewhat dependent on others. The reason that people do not retire wealthy usually has little to do with the lack of income or monster salary, and has everything to do with their spending habits. Perhaps we should not follow the lead of the 95 percent that are heading for failure.

- Spend less than you make.

- I agree with Ben Franklin’s words, “It is the eyes of others and not our own eyes which ruin us.” We live in fear of what the Joneses will say. Many retire with little or nothing to show for their years of toil except junk and worn-out trinkets. A wonderful life awaits those who rise above what others think.

- The Consumerati: they consume all they have and mortgage their futures by borrowing all they can. They are left with little to show for it in the end.

- Reality Math

- Take your net worth, divide it by the number of years you have worked, and that is how much you are working for per year. This is your reality income.

- No matter if you make $100,000 a year, only what adds to your net worth is yours.

- It is a function of what you spend more than what you earn. If you have a net worth of $150,000 and have worked for twenty years, you are in fact working for $7,500 per year. The rest has been burned.

- Delayed gratification and your burn rate will determine your wealth more than income – even a very high income.

- Chapter Five: I Don’t Know About My Past: But My Future Is Spotless!

- Use your past as a reference library – not a place to live!

- It’s never too late to be what you might have been. (George Eliot)

- Bad habit programming is hard to delete from your personal operating system.

- Your environment really does affect your life.

- Mark Victor Hansen says, “You are not born a winner or a loser, you are born a chooser.”

- There is wisdom in many counselors.

- The choice we have when faced with life’s adversities is always to become bitter or better.

- This is your life, not a test run. Change is within the grasp of everyone.

- Many spend their time and money buying things we don’t need, to impress people we don’t like.

- “He who controls the past commands the future. He who commands the future conquers the past.” as George Orwell said.

- Chapter Six: What If You Live? Make Work a Stage of Life – Not a Life Sentence

- Financial success is a function of simple math and delayed gratification. There is dangerous ground between knowing and doing – the great purgatory of inaction. It is here where dreams die, life becomes ordinary, and we train ourselves to accept far less than our potential by always seeking but never coming to an understanding that life is as much doing as thinking.

- If you wish control (your financial life), start sooner on your investment plan, not later.

- At the beginning of every spending situation, they ask, “Does this take me nearer or farther away from my goals.?”

- Most people put off thinking about retirement because they know that they won’t like the answers to the questions they know they must ask.

- Two-thirds of Americans dreams of retirement, while only one-third actually take steps to move in that direction.

- Our chances for success are better with a simple system that we always follow rather than a complex plan that we sometimes follow.

- John Bogle, founder of the Vanguard Mutual Funds, says, “Simplicity gives us the power to do less of what doesn’t matter.”

- Sticking to the fundamentals of money handling will lead us to success. There is no such thing as a new fundamental.

- Thrift is the great educator. To apply thrift to your life, you must plan – you must have a written program to follow. Without such a plan, life is very inefficient and costly. To apply thrift is to understand timing and value. Thrift assumes forethought and careful reasoning. A large income is not necessarily an indicator of wealth. An income of almost any size strained through well-trained habits in time will create wealth.

- It is one thing to admit to your financial shortcomings, yet quite another to escape the consequences.

- You Are Probably Closer Than You Think

- Practical thrift, the right ordering of your finances, the practice of delayed gratification, and monitoring and control of your burn rate may be all that is separating you from the financial life you desire.

- Your burn rate will determine your fate. Spending determines your ending.

- The fundamentals of money and debt do not discriminate. Money will perform equally well for all who will give it employment. A young person who beings to automate deposits into an investment monthly, biweekly, or weekly will end up with wealth far exceeding that of the average American.

- Set up an automatic withdrawal from your paycheck or checking account each month to purchase shares of a mutual fund or bond fund. Begin today.

- Self-Taxation

- We should tax ourselves, not for vice, but for our futures.

- The best way to “collect” the tax for you from yourself is like what the government does, first and often, and by electronic transfer from your paycheck or checking account to a prudent investment. The automation of the deposits is key. This is how the government acquires large piles of taxpayer money to redistribute. Take the concept and make it work for you.

- If you are waiting for someone else to take care of you, it’s not going to happen.

- Without the withdrawals from our wages, the government could not exist. Only your blood (cash) transfusions keep the government pumping.

- We must tax ourselves over and above government’s demands. Then we must invest the proceeds for our future.

- If the government pays itself first from our checks, shouldn’t we at least do the same?

- To Be a Millionaire, You Must First Be a Thousandaire

- Certainly having the first $100 in savings won’t be too exciting. Even becoming a multithousandaire won’t change your life, but by steady stick-to-it-iveness you will eventually become a one-three-, four-, or five-hundred-thousandaire. Then you will notice that things can be a little easier.

- Longfellow wrote, “Most people would succeed in small things if they were not troubled with great ambitions.”

- Youth suffers from inexperience, while old age suffers from youth’s inaction.

- Many of us are only a few feet from success.

- Why Aren’t Most People Successful?

- If success is so easy, why don’t more people succeed? Jim Rohn replies, “Because it’s easy to and it’s easy not to.” The fundamentals of success are easy to apply – it is also easy not to apply them. It is human nature to stay the course, to bend toward the status quo – even if that course is not working.

- Sometimes we stick to what is familiar to us even if it is fiscally imprudent. Plainly, many are comfortable in their bondage.

- Samuel Smiles wrote, “Society at present suffers far more from waste of money than from want of money.”

- Orison Marden said, “Don’t risk your life’s superstructure upon a day’s foundation.”

- Held hostage by their desire to look successful, they eat their seed corn. No seed, no planting – no harvest.

- Sadly, many of us offset every increase in income with new spending without regard to the possibility of outliving our money.

- We live thirty years longer than folks did one hundred years ago. The old witticism “If I had known I would live this long, I would have taken better care of myself: for our purposes could be “If I had know I would live his long, I would have saved or invested more money.” Many allow Parkinson’s second law – “Spending always rises to meet the income available” – to keep them broke throughout their lives.

- In every discussion of retirement or money, remember when to start saving: now! Sooner is better – but more sooner is best.

- To be successful, we must avoid the great disconnect between knowing and doing. Some of us read and study for years, thinking a little more knowledge is all we need to reach the Promised Land. Those who hold knowing or awareness to be equal to doing are forever lost. Some never turn graduation day into application day, when we apply what we have learned.

- “One talent fully developed is worth more than ten talents on a shelf”, says Dr. Marden.

- There are no secrets to wealth and happiness. The answers lie in a few fundamentals: discipline, deferral, and discernment chief among them.

- The best situation is to find work you love and can make money at – and fix your consumption to fit your income.

- A kids’ riddle. “Two frogs sat on a log, and one decided to jump. How many frogs are left?” (Answer: two. Just deciding to do something doesn’t count. You need to actually jump.)

- Tom Hopkins say, “Most people are seven times more concerned with losing what they already have than with getting more.”

- “True maturity is when you realize no one is coming to help.”

- The savings habit will save you. Inconsistency will kill you.

- When we are making little progress or even regressing, we often allow ourselves a free pass by not documenting reality. The freeway of your mind has many exits and distractions. The reality of plans on paper makes it less likely that we will exit at Fantasy land when we need to be in Reality City.

- We choose each day to be a salve of the past or master of our future (financially).

- Burn rate determines fate; your spending will determine your ending. For most readers, spending habits will be their downfall.

- Many people have a money-getting plan without a spending plan – they run roughshod over any true success they are so near by refusing to prioritize and control spending.

- According to Brian Tracy, wrote, “Wealth is the number of days you can exist without working.”

- Income is like a moving river; wealth is like a lake or reservoir. Stored income is wealth; spent income may not even bring fond memories.

- Chapter Seven: Real Estate: Buy Five Houses – Get One Free!

- We often don’t see opportunity because it is wrapped in difficulty or unattractive packaging.

- Your eventual success or failure in real estate will hinge on your ability to find and recognize a bargain.

- You don’t G-E-T if you don’t A-S-K!

- Real estate always has bargains available, they may just be hard to see. Remember, it is a people business – not just real estate. It is this human element of real estate that gives opportunity for great profit. The fact is, you buy real estate from people, it gets used or rented by people by people, and when you sell it, you must entice another human or entity (controlled by people) to pay money to you.

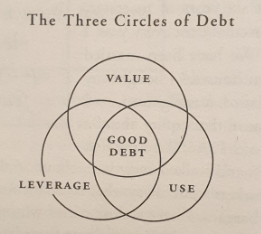

- Circles of Debt

- The circles-of-debt chart applies to all types of good debt, whether for education, real estate, or business investment. The value of any leveraged investment should safely exceed the market for the item.

- The Key: Use Force If Necessary

- The key to making money in real estate is to force inflation or an increase in value. This forced inflation can come by way of either sweat equity (you improve the property by making physical improvements) or finding a bargain.

- You will always do better to make your money buying at a discount. Excellent negotiating skill plus the ability to rally the troops to do improvements could be the best combination.

- Funds already spoken for must remain silent when opportunity knocks.

- Up Debt Creek Without a Paddle

- Most people get into bad debt by thinking emotionally instead of critically.

- The trip up Debt Creek is an emotional trip.

- The Key to Success: Buy Right – Get a Good Deal on the House

- The first mortal sin in real estate is paying too much. The second is not recognizing a good deal when it is right in front of you. The third sin is not getting along famously with people. You need people to buy real estate.

- Chapter Eight: Driving Your Life Away: Are You Driving Your Retirement into the Ground?

- Debt for a car is bad debt. It is a loan on something that decreases in value. It only takes your money.

- Event if you pay cash for your car, truck, or SUV, it still depreciates.

- Cars are commodities. For nearly two-thirds of Americans, cars represent a payment that is included in their burn rate. Until you can pay cash for your vehicles, the best advice is to keep the expense moderate.

- Cars are at best a commodity, a part of your burn rate. While they are part of your burn rate, excessive debt for cars is bad debt, by definition. This is debt that is robbing you of your future.

- Few of us want to admit that our probable lack of retirement savings has to do with our spending habits.

- Few things in life fade as quickly as the “new-car high.” To some, it can be addictive, requiring even more investment to get “high” the next time.

- “Buy less and drive it longer. Invest the difference.”

- A new car may bring short-term happiness but can never bring joy, which I have defined (at least financially) as complete satisfaction that you are doing the best you can with what you have. This is good stewardship – it is maximizing the benefit of your income.

- Depreciation impacts us only when we sell.

- Generally, many of us will spend more when we don’t convert the cost to an actual cash outlay.

- Do not allow yourself to be swept away emotionally by new cars. Make a decision to watch your net worth grow instead of changing the scenery in your driveway every year or two.

- Chapter Nine: Do I Have Records? My Pulse Began to Quicken

- Poor record keeping will cost you money. This is an irrefutable fact.

- Napoleon Hill, writing on failure in his 1928 The Law of Success, says, “Defeat often talks to us in a ‘dumb language’ that we do not understand. If this were not true, we would not make the same mistakes over and over again without profiting by the lessons that they might teach us. If it were not true, we would observe more closely the mistakes which other people make and profit by them.”

- Accurate record keeping will increase your creative ability, not decrease it.

- I Don’t Want to Know

- Perhaps you fall into the category of folks who would rather not know exactly where they are financially.

- If you have economic cancer of the bone, wouldn’t it be better to know? The earlier you detect something like this, the better the chance for remission or even full recovery. Most of us need a transplant, not of economic marrow, but of economic thinking.

- Denial or delusion is not only unhealthy – it can be financially devastating. Find out where you are financially.

- If you make $48,000 a year and are able to invest $5,000 a year, you are far better off than Doctor Lotta Bucks making $273,000 a year and saving or investing nothing. It is not the amount you make; it is the amount you do something wise with. Wealth is not about income; it’s about accumulation and investment.

- Without good records, you are flying with no fixed point of reference.

- Budgets

- Don’t start with a budget; start with an actual tabulation of what you are currently spending. You will need a budget for forecasting likely expenses, but it is your goals and desires that keep spending in line. You know the big stuff: rent or mortgage, transportation, Insurance, and so on. The problem is probably in the petty cash leakage. It’s easy to saw through $300 to $600 or $1,000 a month in small, insignificant things. The preceding numbers are based only on $10 to $34 a day. Whether in cash or charge, it adds up if you are looking for retirement or special project money.

- The Latte Factor: money that you just spend but really don’t think about. It can add up to a fortune over time.

- Once you have a few months of expenses in your record system, you will automatically have a budget. It may not be a good one, but it will be an actual budget, not a budget of where you think you are.

- Working from actual spending is less frustrating than working from what you think you should be spending.

- Get some type of system. It has often been said that system is an acronym for save yourself time, energy, and m

- Everyone should have a system. Whatever your system is, make sure that it can catch everything down to the quarter you flip into the bum’s hat.

- Tabulation beats speculation as to where the money went.

- Only with accurate accounting can you safely increase and monitor your net worth and cash flow.

- Your core desire to be successful will outlast and outperform any budget or list of goals you make. When you know why, how, and what “success” will mean to you, this is your most powerful tool. Your “why” must be bigger than you “how.”

- Chapter Ten: You Married Who? The Ultimate Good Debt – Maybe

- “Marriage may make or mar your entire life. It can build you up or tear you down. It can ennoble every phase of your character, or it can make you a cringing failure. It is a perilous mistake that so few men or women receive any sort of correct instruction about the problems of married life.”

- A good marriage adds to your life, much like good debt. An ill-conceived marriage, much like bad debt, may drain your emotions daily. Just as your financials statement may be improved, so may your marriage balance sheet. Marriage has a cost in both time and resources. A good marriage creates a dynamic return where the benefits far exceed the costs. A good marriage is your highest-returning good debt.

- Currently 50 percent of marriages – end in divorce – the other 50 percent end in death.

- Whom you marry will greatly affect your financial future.

- Financial problems can be a black cloud over many marriages. How a husband and wife handle their finances is not the only test of character in a marriage – but a very practical one.

- Marriage counselors tell us that the number one cause of conflict in marriage – even more than issues of personality and kindness – is finances. An often-quoted statistic says that 80 percent of divorces are a direct result of financial difficulties.

- 85 percent of the satisfaction you ever know comes from your relationships with others, and the relationship with your spouse is the key.

- “Take the daughter of a good mother,” is nineteenth-century advice not to be ignored!

- If you always do common things you will have a common life.

- When dating, men and women alike display themselves in the showroom, where everything is quite lovely. The sale is made and everything is fine, until a service or warranty issue arises. Then often we find the sales department has overpromised and the service department will not honor the promises of the salesperson. Perhaps we should ask early, “Will I service what I sell?”

- A financially healthy marriage will encourage open discussions of spending, saving, investing, borrowing, tax planning, bequeathing, and charitable giving.

- Chapter Eleven: Debt Warfare: When Push Comes to Shove

- Save or Pay Off First?

- The question always arises should I save and then pay off debt? Or just go all out on debt and then save? The first thing I recommend is to pay off credit cards and put them in a drawer and leave them alone.

- Common Sense and Principle Reduction

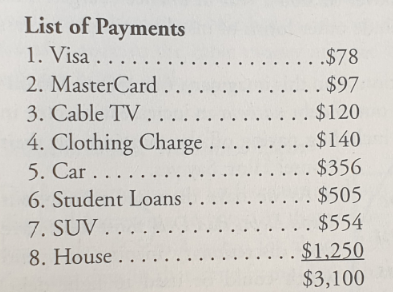

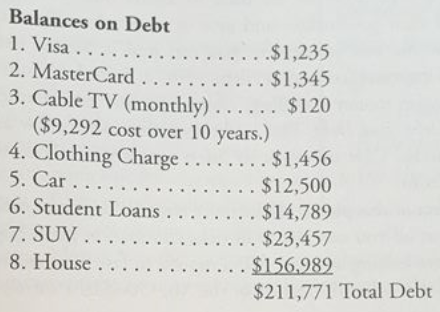

- List your bills from smallest monthly payment to the largest payments.

- List your bills from smallest balance to the largest.

- This covers basic debt reduction and not all the expenses you will commonly have.

- Right now the best investment you can find is buying back your self-imposed consumer debt.

- Most folks have some discretionary income to spend which could be used to fight debt.

- Certainly the cost of higher education can be a good debt, buy only if application of what you learn can be sold in the marketplace for a profit.

- Once the past is paid for you can build for the future. This concept of debt warfare is just another twist on LERI – Lower Expenses and Raise Income. Lower expenses, raise income, and do something wise with the difference.

- If you consider each of your dollars a little dollar soldier, then only those you have not sent over to the enemy can work for you. Conversely your dollar soldier’s children cannot multiply to your benefit “under the command of a foreign army”? This is when the supermajority of your dollar soldiers [income] is already obligated to debt and is not producing a return for you. Consider a coup by killing off debt to regain control of your soldiers and keep them marching under your own flag.

- Conclusion

- Failure is God’s way of saying, “Excuse me, you are headed in the wrong direction.” (Oprah Winfrey)

- At their core, the concepts of Good Debt, Bad Debt are easy to understand but hard to apply.

- Financial success is rather simple, and that daily actions decide the realities of tomorrow. There are few things, aside from health, that affect as many areas of your life as do you finances.

- Understanding the concepts of the debt effects, emotional management, burn rate, and delayed gratification can change your life. If you understand and apply these principles in your life, you will finish far ahead of the majority of people in this consumption-driven society.

- It is disingenuous to imagine ourselves millionaires while not even taking steps to first be thousandaires.

- Remember Longfellow’s words, “Most people would succeed in small things if they were not troubled with great ambitions.” This is how most of us fail, by ignoring the small things, the simple daily duties of life that are really the building blocks of our greater ambitions.

- I have tried to impart one simple message: think! Think about how today’s actions will affect what you can do in the future.

- What to do is simple; carrying it out over twenty years or more is where it is difficult.

- The good investment is getting rid of bad debt.

- If what you owe for can easily pay its way by being sold, or hopefully from cash flow it produces, then it is good debt.

- Whenever debt is used for greed, impatience, or an appearance of wealth, it rarely becomes a blessing.

- While greed and impatience may get a pass once in a while, debt employed to make us appear to be something we are not is always bad debt, and generally has consequences far above the interest paid.

- The less encumbered we are, the more free we become, and freedom is all wealth can really buy. It seems that we sell our brains or brawn in the market, but what we are really selling is part of our humanity – our remaining time on this earth.