Have you ever thought about writing a book, starting a YouTube Channel, starting a Podcast or starting a business? My name is Michael Knight founder of Bestbookbits. Apart from creating the worlds largest free book summary bestbookbits, I run a successful YouTube Channel with 60k+ subs, a global top 40 podcast and author of “Success in 50 Steps.” I consult with new content creators that want to write a book, start and grow a YouTube Channel or a Podcast Show. To work with me on getting this done with you, book a free call here.

FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Now we at bestbookbits have created something special for you. I have packaged the wisdom of $13,000 of books into a box set almanac of 500 book summaries in 17 volume’s 8,500 page MONSTER BOOK. Plus a bonus stack of 681+ Downloaded MP3 Book Summaries. Click here to grab it now.

Chapter One: LESSON 1: The Rich Don’t Work for Money

The poor and the middle class work for money, the rich have money work for them.

- True learning takes energy, passion and a burning desire.

- It is fear that keeps most people working at a job.

- Most people become a slave to money.

- Learn to have money work for you.

- Too many people are focused too much on money and not their greatest wealth, which is their education.

- Pay yourself first.

- So many people say, “Oh, I’m not interested in money.” Yet they’ll work at a job for eight hours a day.

- Intelligence solves problems and produces money. Money without financial intelligence is money soon gone.

- Taxes, you’re taxed when you earn, you’re taxed when spend, you’re taxed when you save and you’re taxed when you die.

Chapter Two – LESSON 2: Why Teach Financial Literacy?

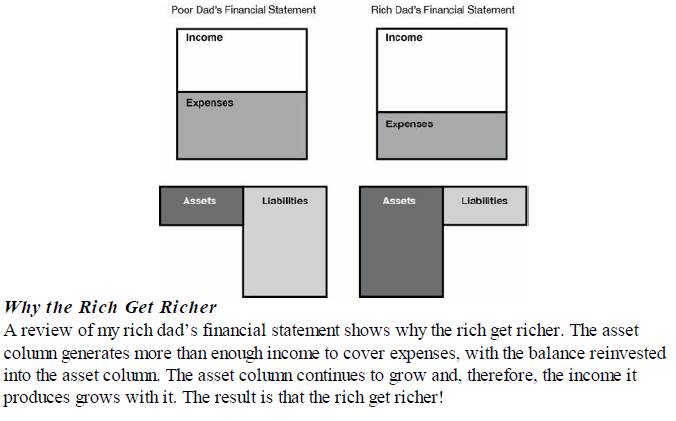

It’s not how much money you make, it’s how much money you keep.

- If you want to be rich, you need to be financially literate.

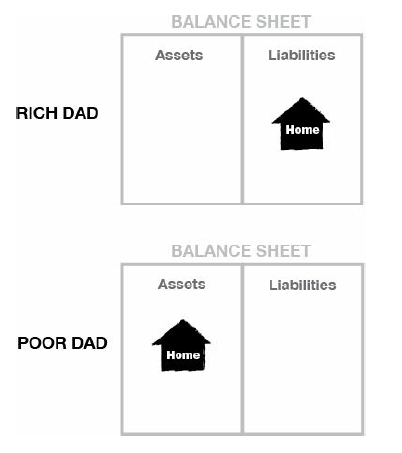

- You must know the difference between an asset and a liability, and buy assets.

- Rich people acquire assets. The poor and middle class acquire liabilities, but they think they are assets.

- If you want to be rich, you’ve got to read and understand numbers.

- The rich acquire assets and the poor and the middle class acquire liabilities.

- Assets put money in your pocket.

- An asset is something that puts money in my pocket. A liability is something that takes money out of my pocket.

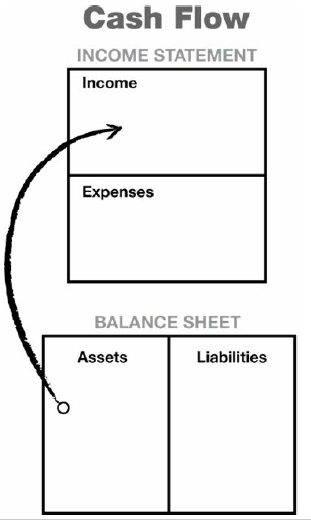

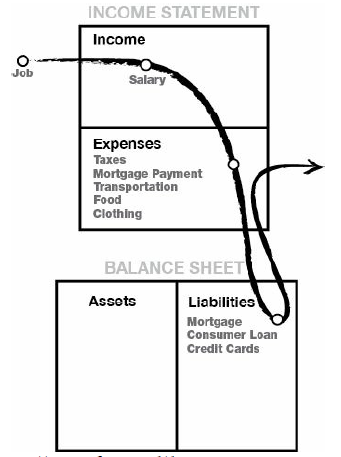

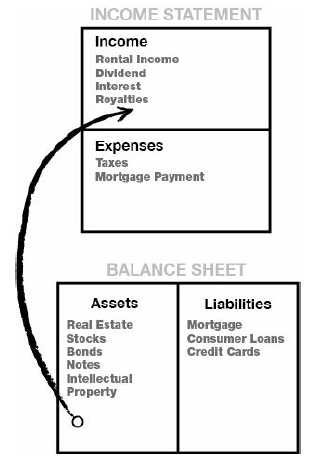

- This is the cash -flow pattern of an asset:

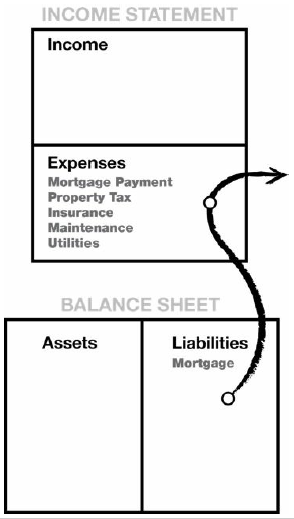

- This is the cash-flow pattern of a liability:

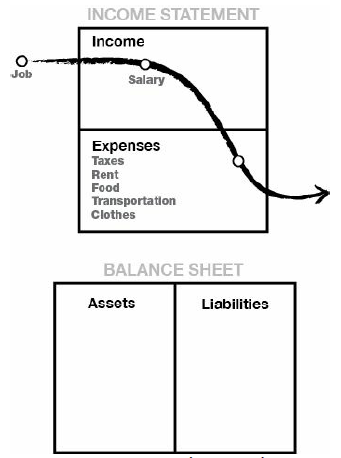

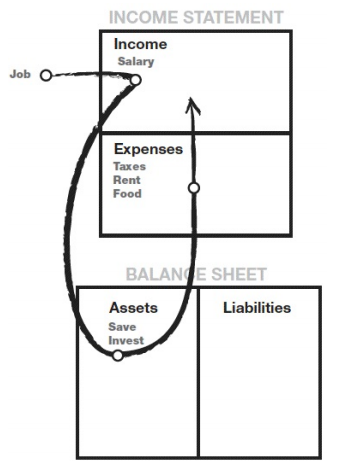

- This is the cash-flow pattern of a poor person:

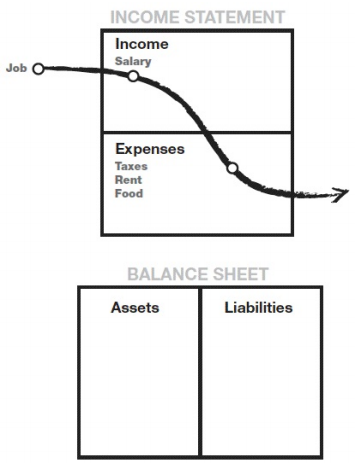

- This is the cash-flow pattern of a middle class person:

- This is the cash-flow pattern of a wealthy person:

- Illiteracy, both in words and numbers, is the foundation of financial struggle.

- It is the cash flow that tells the story. It is the story of how a person handles their money, what they do after they get the money in their hand.

- The number-one expense for most people is taxes.

- A person can be highly educated, professionally successful, and financially illiterate.

- A fool and his money is one big party.

- Their spending habits have caused them to seek more income.

- More money seldom solves someone’s money problems. Intelligence solves problems.

- If you find you have dug yourself into a hole…stop digging.

- Remember the golden rule. He who has the gold makes the rules.

- According to psychiatrists, the fear of public speaking is caused by the fear of ostracism, the fear of standing out, the fear of criticism, the fear of being an outcast. The fear of being different prevents most people from seeking new ways to solve their problems.

- It is only when we as humans look into the mirror do we find truth.

- The fear of ostracism that causes people to conform and not question commonly accepted opinions or popular trends.

- An intelligent person hires people who are more intelligent than they are.

- Schooling process actually discourages creativity.

- Schools were designed to produce good employees instead of employers.

- When it comes to money, high emotions tend to lower financial intelligence.

- Money has a way of making every decision emotional.

- Because they have no money to invest, they simply do not invest.

- Investing in income-producing assets.

- The rich buy assets, the poor only have expenses, the middle class buys liabilities they think are assets.

Chapter Three: LESSON 3: Mind Your Own Business

- The rich focus on their asset columns while everyone else focuses on their income statements.

- Financial struggle is often directly the result of people working all their life for someone else.

- The mistake is becoming what you study is that too many people forget to mind their own business.

- Your business revolves around your asset column, as opposed to your income column.

- The rich focus on their asset columns while everyone else focuses on their income statements.

- Cling to their jobs.

- Life is sometimes tough when you do not fit the standard profile.

- Keep your daytime job, but start buying real assets, not liabilities or personal effects that have no real value once you get them home.

- Keep your expenses low, reduce your liabilities and diligently build a base of solid assets.

- Real assets falls into several different categories

- Businesses that do not require my presence. I own them, but they are managed or run by other people. If I have to work there, it’s not a business. It becomes my job

- Stocks

- Bonds

- Mutual funds

- Income-generating real estate

- Notes (IOUs)

- Royalties from intellectual property such as music, scripts, patents and anything else that has value, produces income or appreciates and has a ready market.

- An employee with a safe, secure job, without financial aptitude, has no escape.

- The first lesson of having money work for me, as opposed to working for money, is really all about power, If you work for money, you give the power up to your employer. If your money works for you, you keep and control the power.

- Start minding your own business. Keep your daytime job, but start buying real assets, not liabilities.

Have you ever thought about writing a book, starting a YouTube Channel, starting a Podcast or starting a business? My name is Michael Knight founder of Bestbookbits. Apart from creating the worlds largest free book summary bestbookbits, I run a successful YouTube Channel with 60k+ subs, a global top 40 podcast and author of “Success in 50 Steps.” I consult with new content creators that want to write a book, start and grow a YouTube Channel or a Podcast Show. To work with me on getting this done with you, book a free call here.

FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Now we at bestbookbits have created something special for you. I have packaged the wisdom of $13,000 of books into a box set almanac of 500 book summaries in 17 volume’s 8,500 page MONSTER BOOK. Plus a bonus stack of 681+ Downloaded MP3 Book Summaries. Click here to grab it now.

Chapter 4: LESSON 4: The History of Taxes and the power of Corporations

- You need to know the law and how the system works.

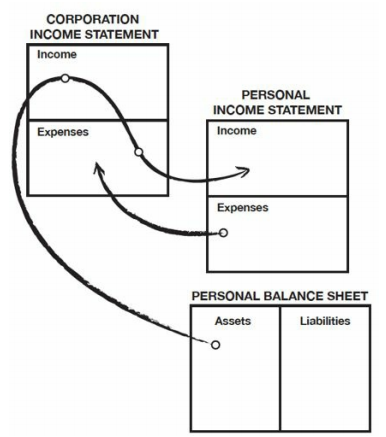

- The diagram shows how the corporate structure sits outside your personal income statement and balance sheet.

- Each dollar in my asset column was a great employee, working hard to make more employees and buy the boss a new Porsche.

- Be smart and you won’t be pushed around as much.

- If you know you’re right, you’re not afraid of fighting back.

- By relying solely on a paycheck from a corporate employer, I would be a docile cow ready for milking.

- Why not own the ladder.

- Idea of owning my own corporation.

- Financial IQ is made up of knowledge from four broad areas of expertise.

No. 1 is accounting. No. 2 is investing. No. 3 is understanding markets. No. 4 is the law.

In summary:

Business Owners with Corporations

- Earn

- Spend

- Pay Taxes

Employees Who Work for Corporations

- Earn

- Pay Taxes

- Spend

Chapter Five: LESSONS 5: The Rich Invent Money

Often in the real world, it’s not the smart who get ahead, but the bold.

- The one thing that holds all of us back is some degree of self-doubt.

- It is not so much the lack of technical information that holds us back, but more the lack of self-confidence.

- In the real world outside of academics, something more than just grades is required, I have heard it called guts, balls, audacity, bravado, cunning, daring, tenacity and brilliance. This factor, whatever it is labeled, ultimately decides one’s future much more than school grades.

- I recognized that it was excessive fear and self-doubt that were the greatest detractors of personal genius.

- It’s not the smart that get ahead but the bold.

- If fear is too strong, the genius is suppressed.

- Take risks, to be bold, to let their genius convert that fear into power and brilliance.

- Most people only know one solution: work hard, save and borrow.

- The more real you think money is, the harder you will work for it. If you can grasp the idea that money is not real, you will grow rich faster.

- The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth in what seems to be an instant.

- An untrained mind can also create extreme poverty that lasts lifetimes by teaching it to their families.

- Money did not change hands. Agreements did.

- Financial intelligence is made up of these four main technical skills.

- Financial literacy. The ability to read numbers

- Investment strategies. The science of money making money

- The market. Supply and demand

- The law. The awareness of accounting, corporate, state and national rules and regulations. I recommend playing within the rules.

- The more I learn – and there is a lot to learn – the more money I make simply because I gain experience and wisdom as the years go on.

- Great opportunities are not seen with your eyes. They are seen with your mind.

- My overall philosophy is to plant seeds inside my asset column.

- Invest more in their financial education than in the stock, real estate or other markets. The smarter you are, the better chance you have of beating the odds.

- We learn by making mistakes. We learn to walk by falling down. If we never fell down, we would never walk.

- Unfortunately the main reason most people are not rich is because they are terrified of losing.

- Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success.

- It’s what you know more than what you buy. Investing is not buying. It’s more a case of knowing.

- It is what you know that is your greatest wealth. It is what you do not know that is your greatest risk.

- They are one skill away from great wealth.

- Most people need only to learn and master one more skill and their income would jump exponentially.

Chapter 6: LESSON 6: Work to Learn – Don’t Work for Money

Job security meant everything to my educated dad. Learning meant everything to my rich dad.

- You want to know a little about a lot.

- The hardest part of running a company is managing people.

- Job is an acronym for ‘Just Over broke.’

- Most workers “live within their means.”

- Workers work hard enough to not be fired, and owners pay just enough so that workers won’t quit.

- Education is more valuable than money, in the long run.

- The world is filled with talented poor people.

- The main management skills needed for success are:

- The management of cash flow

- The management of systems (including yourself and time with family

- The management of people.

- The most important specialized skills are sales and understanding marketing.

- It is communication skills such as writing, speaking and negotiating that are crucial to a life of success.

- In addition to being good learners, sellers and marketers, we need to be good teachers as well as good students. To be truly rich, we need to be able to give as well as to receive.

- Practice to give first.

- The more they gave, the more they received.

Chapter 7: Overcoming Obstacles

The primary difference between a rich person and a poor person is how they manage fear.

- Five main reasons why financially literate people may still not develop abundant asset columns: fear, cynicism, laziness, bad habits, arrogance.

- The greatest reason for lack of financial success was because most people played it too safe.

- For most people, the reason they don’t win financially is because the pain of losing money is far greater than the joy of being rich.

- Failure inspires winners. Failure defeats losers.

- If you have any desire of being rich, you must focus.

- Put a lot of your eggs in a few baskets. Do not do what poor and middle class people do: put their eggs in many baskets.

- Our doubts often paralyze us.

- Doubt is expensive.

- Cynics criticize, and winners analyze.

- They don’t make money because they chose to not lose money.

- Laziness by staying busy.

- Our world progresses because we all desire a better life.

- Eleanor Roosevelt said it best: “Do what you feel in your heart to be right – for you’ll be criticized anyway. You’ll be damned if you do, and damned if you don’t.

- Rich dad believed that the words “I can’t afford it” shut down your brain. “How can I afford it?” opens up possibilities, excitement, and dreams.

- If I pay myself first, I get financially stronger, mentally and fiscally.

Chapter 8: Getting Started

There is gold everywhere. Most people are not trained to see it.

10 Steps as a process to develop your God-given powers, powers over which only you have control

- Find a reason greater than reality: the power of spirit

- Most people choose not to be rich.

- Make daily choices: the power of choice

- Our spending habits reflect who we are. Poor people simply have poor spending habits.

- Arrogance is ego plus ignorance.

- Just because you have no money, it should not be an excuse to not learn.

- Invest first in education. In reality, the only real asset you have is your mind.

- Arrogant people rarely read or buy tapes. Why should they? They are the center of the universe.

- Intelligence combined with arrogance equals ignorance.

- Choose friends carefully: the power of association

- Chickens of a feather agree together.

- Master a formula and then learn a new one: the power of learning quickly

- A truly intelligent person accumulated ideas.

- Listening is more important than talking. If that was not true, god would not have given us two ears and only one mouth.

- One of the hardest things about wealth building is to be true to yourself and be willing to not go along with the crowd.

- Master a formula and then learn a new one.

- You become what you study.

- Pay yourself first: the power of self-discipline.

- If you cannot get control of yourself, do not try to get rich.

- The lack of personal self-discipline that is no.1 delineating factor between the rich, the poor and the middle class.

- The world will push you around. The world pushes people around not because other people are bullies, but because the individual lacks internal control and discipline. People who lack internal fortitude often become victims of those who have self-discipline.

- The three most important management skills necessary to start your own business are:

- Management of cash flow

- Management of people

- Management of personal time.

Have you ever thought about writing a book, starting a YouTube Channel, starting a Podcast or starting a business? My name is Michael Knight founder of Bestbookbits. Apart from creating the worlds largest free book summary bestbookbits, I run a successful YouTube Channel with 60k+ subs, a global top 40 podcast and author of “Success in 50 Steps.” I consult with new content creators that want to write a book, start and grow a YouTube Channel or a Podcast Show. To work with me on getting this done with you, book a free call here.

FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Now we at bestbookbits have created something special for you. I have packaged the wisdom of $13,000 of books into a box set almanac of 500 book summaries in 17 volume’s 8,500 page MONSTER BOOK. Plus a bonus stack of 681+ Downloaded MP3 Book Summaries. Click here to grab it now.

People Who Pay Themselves First

People Who Pay Everyone Else

- Having the guts to go against the tide and get rich.

- Don’t get into large debt positions that you have to pay for. Keep your expenses low. Build up assets first.

- Poor people have poor habits. A common bad habit is innocently called “Dipping into savings”. The rich know that saving are only used to create more money, not to pay bills.

- If you’re not tough inside, the world will always push you around anyway.

- Pay your brokers well: the power of good advice

- Limit my losses to only the money I have in at that time.

- Be an Indian giver: the power of getting something for nothing

- Learn how to have money work for you.

- The sophisticated investor’s first question is: “How fast do I get my money back?”

- Too often today, we focus on borrowing money to get the things we want instead of focusing on creating money.

- Remember, the easy road often becomes hard, and the hard road often become easy.

- Use assets to buy luxuries: the power of focus

- To be the master of money, you need to be smarter than it.

- When it comes to investing, too many people make it sound hard. Instead find heroes who make it look easy.

- Choose heroes: the power of myth

- Teach and you shall receive: the power of giving

Chapter 9: Still Want More? Here are some to do’s

- Stop doing what is not working and look for something new to do.

- Find someone who has done what you want to do.

- Make lots of offers. When I want a piece of real estate, I look at many properties and generally write an offer. If you don’t know what the “right offer” is, neither do I. That is the job of the real estate agent. They make the offers. I do as little work as possible.

- Most sellers ask too much. It is rare that a seller will actually ask a price that is less than something is worth.

- Make offers. People who are not investors have no idea what it feels like to be trying to sell something.

- Search, offer, reject, negotiate and accept are all parts of the process of almost everything in life.

- You need to know what you’re looking for and then go look for it.

- Profit is made when you buy, not when you sell.

- I shopped at the foreclosure department of a bank. I paid $500 for a class on how to do this.

- Buy the pie and cut it in pieces.

- Small thinkers don’t get the big breaks. If you want to get richer, think bigger first.

- Small people remain small because they think small; act alone, or don’t at act all.

- Learn from history. All the big companies on the stock exchange started out as small companies.

- Action always beats inaction.

- The important words being “done” and “do”. You must take action before you can receive the financial rewards. Act now.

- Without financial training, we all too often use the standard formulas to get through life, such as to work hard, save, borrow and pay excessive taxes. Today we need better information.

- Money is only as idea. If you want more money simply change your thinking. Every self-made person started small with an idea, then turned it into something big. The same applies with investing. It takes only a few dollars to start and grow it into something big.

- It’s what is in your head that determines what is in your hands.

- Today, don’t play it safe, play it smart.

- The three incomes: earned income, passive income, portfolio income.

- The key to becoming wealthy is the ability to convert earned income into passive income and/or portfolio income as quickly as possible.

- The taxes are higher on earned income. The least taxed income is passive income.

- All a real investor does is convert earned income into passive and portfolio income.

- You could never learn to ride a bicycle by only reading a book.

- Warren Buffet says “Risk comes from not knowing what you’re doing.”

- If you do not know those differences in the three incomes and do not learn the skills on how to acquire and protect those incomes, you will probably spend your life earning less than you could and working harder than you should.

- Earned income is money you work for and passive and portfolio income is money working for you.

- The main reason people struggle financially is because they spent years in school but learned nothing about money. The result is, people learn to work for money…but never learn to have money work for them.

- Take responsibility for your finances or take orders all your life. You’re either a master of money or a slave to it.

Have you ever thought about writing a book, starting a YouTube Channel, starting a Podcast or starting a business? My name is Michael Knight founder of Bestbookbits. Apart from creating the worlds largest free book summary bestbookbits, I run a successful YouTube Channel with 60k+ subs, a global top 40 podcast and author of “Success in 50 Steps.” I consult with new content creators that want to write a book, start and grow a YouTube Channel or a Podcast Show. To work with me on getting this done with you, book a free call here.

FOLLOW US HERE > |YouTube |Spotify | Instagram | Facebook | Newsletter | Website

Now we at bestbookbits have created something special for you. I have packaged the wisdom of $13,000 of books into a box set almanac of 500 book summaries in 17 volume’s 8,500 page MONSTER BOOK. Plus a bonus stack of 681+ Downloaded MP3 Book Summaries. Click here to grab it now.

2 comments on Robert Kiyosaki: Rich Dad Poor Dad Book Summary

Leave a Reply

You must be logged in to post a comment.

Love the work you are doing !

Are able to summarize ‘Guide to investing in Gold and Silver’ by Mike Maloney?

It is a really good book about money and the monetary system, especially his documentary on ‘Hidden Secrets of Money’: https://www.youtube.com/watch?v=DyV0OfU3-FU&list=PLE88E9ICdipidHkTehs1VbFzgwrq1jkUJ

thanks farzand, will check it out and do it, great stuff